Read the latest market updates on services, routes, and rates.

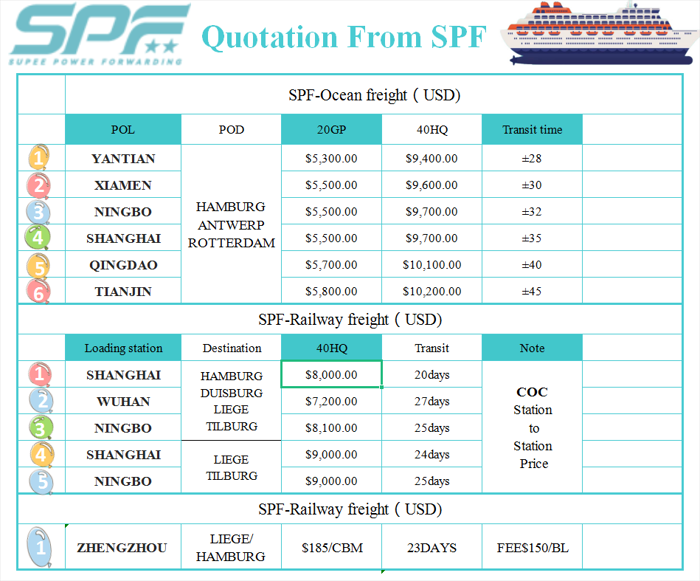

Rates:

- Container lines operating on Indian trades have started imposing charges on customers that failed to fulfill their bookings as committed. For contract clients, they are from $100 to $400/container. For walk-in customers, they are aroundS$1,000/box.

Deep sea services:

- Hapag-Lloyd expands its African network by adding the new Maputo Express service that rotates as follows: Mundra, India - Jebel Ali, UAE - Maputo, Mozambique.

- 2M Alliance makes changes in the schedule. Asia to US and Canada West Coast omissions: week 25, Eagle service, vessel names: Maersk Seville (current voyage number: 225N) and Anna Maersk (current voyage number: 223N).

- 2M Alliance Asia to US East Coast omissions: week 26, America, Adrian Maersk (current voyage number: 227E). Week 25, Empire, Gerda Maersk (current voyage number: 225E). Week 23, Elephant, Maersk Skarstind (current voyage number: 224E).

- The ports of Newark and Savannah on the America and Liberty services will be reinstated.

- The second Newark call on the Empire service will be temporarily removed.

- Allseas has given Bangladeshi exporters their first direct sailing to North Europe.

Multimodal services:

- Maersk has launched an alternative Asia-Europe rail-sea service via Central Asia and the Black Sea. It starts from multiple locations in China, crosses the China-Kazak border at Khorgos, and goes by rail to Aktau, then to Baku in Azerbaijan. After containers are dispatched to Europe through Poti in Georgia and Constanta in Romania. Transit time from origin to destination is around 40 days. The annual capacity is 150,000 TEU.

Rail services:

- CFL Intermodal has added an extra weekly roundtrip to the Battembourg-Poznan train service. Now it can make a stopover in Luxembourg and then continue all the way to Lyon in southern France and Spain via the Le Boulou terminal. Starting from mid-June, the capacity distribution will shift to 11 pocket and 8 Modalohr wagons.

- The heavily congested port of Constanta pushes COSCO Shipping Lines Romania to consider launching a container train service between the Greek port of Piraeus and Romanian terminals to streamline container traffic.

- Chengdu and Chongqing have a new shuttle running between them, becoming the first freight train servicing this economic circle. This launch is the indicator of an increased tendency to shift to rail.

- The train transporting sugar between Nanning International Railway Port in Guangxi, China, and Almaty, Kazakhstan, is now up and running. The transit time is 11 days.

- GEFCO has implemented a road-rail service to transport car parts for Toyota between Spain and northern France with two daily roundtrips.

- The Baltic railway companies are working on improving the Amber Train service connecting the Baltic states with Scandinavia and Western Europe to make it more competitive and profitable. The negotiations are already taking place.

Routes:

- The Trans-Afghan railway between Uzbekistan and the ports of Pakistan project is in progress. It is supposed to run from Termiz in Uzbekistan to Mazar-e Sharif, Kabul, Jalalabad, and eventually cross the border to Peshawar in Pakistan. So far, only the roadmap has been completed. Financing remains one of the main hurdles.

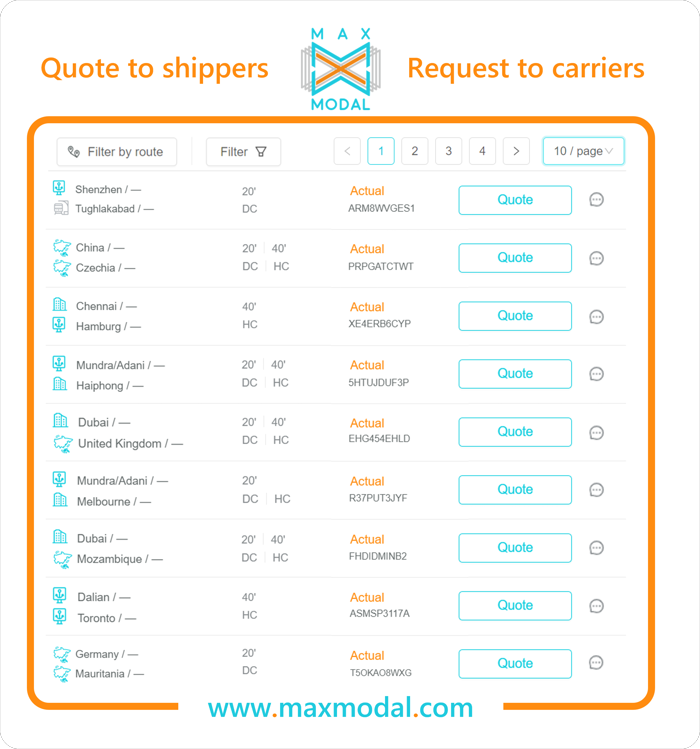

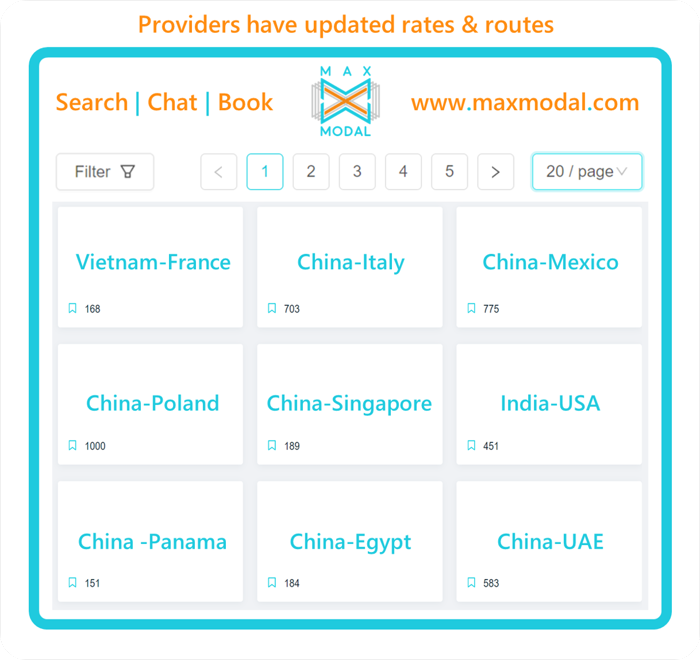

These are only several changes that occurred in more than 250 bn freight rates across 25 million routes. Want to share some news about your services and routes? Just post them on MAXMODAL, a multimodal network that digitally connects routes and rates worldwide to automate sales and operations. Join to innovate.

Hamburg experiences disruptions with its rail freight services. The German port cannot receive any more export trains for the time being due to a combination of factors that include limited track capacity, already delayed services, and reconstruction works.

Need new sales leads or the best quotes? Get both of them. Just push the «Requests» button in the left menu.

Need to optimize your booking costs?

You no longer have to visit many websites and sort their pricing mess.

Just push the button “search rates on the market” in the left menu to search rates, negotiate terms, and book shipments with selected providers

Hello I am looking for Freight forwarder from Japan

and Nissin Corp.

Top 3 forwarders from Japan : Yusen Logistics/NYK Logistics, Nippon Express and

Kintetsu World Express

This is a sea freight type of relocation service which offers personal effect shipment from Hong Kong to UK anywhere.

Learn how easy to post requests.

Rate procurement made easy with MAXMODAL multimodal network

Do you need China import and export logistics?

Plaese contact me.whatsapp:+8618476972618

China to Southeast Asia, the United States, Africa, European ports