For All partners send us confirm inquiry and get direct commission to your any bank card in world ,from our DUBAI bank or cash.

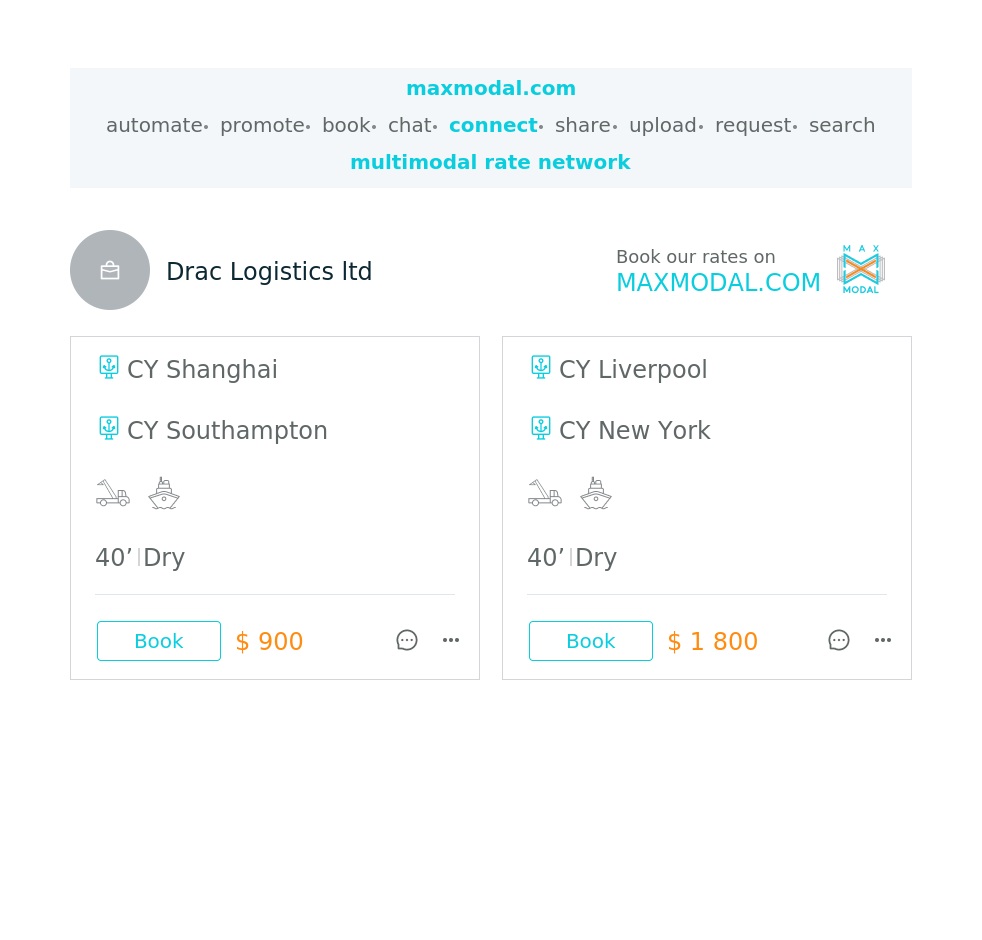

Dear Murad, you can multiply effect for your advertising here. Just post your freight rates here and share them. Clients will be able to book your freight services shared from maxmodal directly on Facebook, LinkedIn, WhatsApp, WeChat and many other digital sales channels.

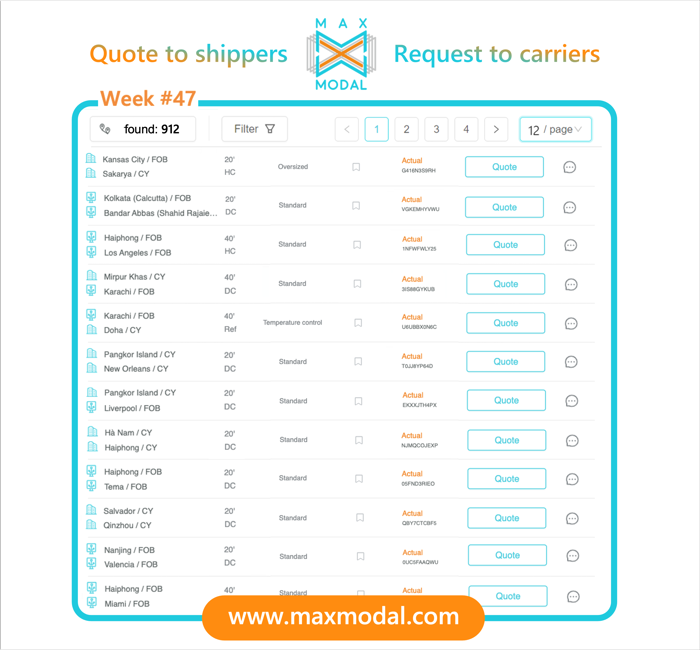

These are just a few examples of new requests at week #47. To get more fresh inquiries and\or the best quotes click here or push the «request management» button in the left menu.

We are active in International Logistic, Transportation and Shipping Services.

Active in Asia, Iran Neighboring Countries, CIS countries, Russia, Middle East, Africa, Europe, South USA Countries

,

Danish

+9899 6216 71 85

Dear Partner ,

As a business manager, you know how important it is to have a reliable logistics partner from UAE,SAUDIA,AFRICA,MALASYIA ,INDIA ,PAKISTAN ,USA, CIScountry, Ukrain,RUSSIA, China, Korea, Asia, Eourop. That's why I'm writing to introduce you to our company.

Goodrich Logistics in Dubai is an NVOCC company with over 90,000 own containers of all types and 35 office international . We offer a full range of logistics services, including transportation, warehousing, containers, inspections and preparation of all shipping documents.

Goodrich logistics also provides additional services such as custom order fulfillment, inventory management and customs brokerage. More information can be found in the attached file and on the Goodrichlogistics.com website.

Thank you for choosing Goodrich as your logistics partner. We believe our services can help your business grow. So hope to receive a response from you soon.

Sincerely,

Murad Zendaki

Great, where to see your freight rates here?

After recording gains across the board last week, the container spot market indices are back to flashing red for the main east-west tradelanes.

It is confirmation that ocean carrier 1 November FAK (freight all kinds) GRIs (general rate increases), from Asia to Europe in particular, have run out of steam and only achieved a small percentage of the ask.

And this also explains why carriers have been obliged to make a final re-set attempt to push up spot rates on the route before the year closes by rolling out fresh, but identical, GRIs for 1 December.

Drewry’s WCI Asia-North Europe component slipped 4% this week, for an average of $1,227 per 40ft, and is 43% lower than the same week of last year.

Earlier in the week, the Ningbo Containerized Freight Index (NCFI) commentary flagged up the declining trend, reporting prices to North Europe and the Mediterranean had “fallen sharply after being briefly pushed up”.

Moreover, The Loadstar’s regular shipper contacts reported that Asia-North Europe carriers were back to discounting directly, after a period when pricing had been largely driven by NVOCC co-loaders.

One UK-based shipper told The Loadstar a top-three carrier had extended his heavily discounted rates from Dalian to Felixstowe through to a latest departure date of 4 January, with no December GRI.

And Singapore-based AGX told that getting the 1 December GRIs to stick was, in its opinion, “doubtful”.

News that Flexport has done a deal with Canada’s WestJet Cargo to fill its leased aircraft out of the US to Asia, has again put the spotlight on the close relationships between carriers and forwarders that exclude others.

One North American source noted that the deal, which sees Canadian cargo brought into the US by WestJet and then flown to Asia by Flexport, had “alienated most large forwarders”.

But perhaps of more concern for other forwarders – and shipping lines – is the relationship between CMA CGM and its subsidiary Ceva, according to a source within CMA CGM Group.

“Other forwarders should definitely be wary, their concerns are completely justified,” warned the source.

“Ceva is told to tell other shipping lines there is an internal policy of giving no more than 20% of volume to CMA on any particular trade. This is false,” claimed the source.

“Overall, CMA group has more than 50% of the Ceva volume, and on some trades it’s much higher. In the current market conditions, when carriers are needing volume, CMA demands Ceva support it above other carriers. We believe there are internal emails sent to ensure volumes are diverted to CMA from other carriers.”

The Dutch Ministry of Infrastructure has decided to reconstruct the Sluis II multimodal complex near Tilburg, Southern Netherlands, and allow larger ships to pass through it. Sluis II is located on the Wilhelmina Canal and is critical for multimodal connectivity in the broader Benelux area. The latest development is also particularly good news for Barge Terminal Tilburg (BTT) engaging in inland waterways-rail transport.

“You have everything in Tilburg to get freight traffic from the road to inland waterways,” said the outgoing Dutch minister of infrastructure and water management, Mark Harbers, to Dutch media. “There are rail connections, there are pipelines. Then, it is important that we can also start using this, not only for Tilburg but for the whole region. We want to submit the project plan this year and then start the tender. I think it’s realistic that we can start working with a contractor in 2025.”

Harbers’ words will be music to the ears of BTT director Wil Versteijnen. BTT is a family business in sustainable container logistics, with its own barge and rail terminals in Tilburg, Eindhoven and Bergen op Zoom. Goods come to Tilburg from all over the world, and from there, they are transported further by water or rail.

The company has one rail and two inland shipping terminals in the vicinity of Tilburg, southern Netherlands. The company operates 14 ships and two locomotives of its own. Versteijnen compared his company’s business to a kitchen while speaking to Dutch media. “The ports are the cooks; we supply and serve. Without us, the kitchen gets stuck. Rotterdam has signed an environmental covenant stating that by 2030, no less than 65 per cent of containers must enter the country by rail or barge, no longer by truck. That’s only about 40 per cent now.”

Operations at Australia’s largest ports are slowly resuming

Just post your freight rates on maxmodal to share them worldwide with your clients and partners