we I J Logistics International Pakistan which was Founded In Jan 2003, In the Field of Air Sea Freight Forwarding ,Total Logistics , Shipping , NVOCC Services with DDP DDU Custom Clearance Services, export /Import Nomination Destination Handing Agent Services, Project Cargo Services, Bonded & Non Bonded Transportation to all Pakistan and Transshipment to Afghanistan . if any one looking for strong and Honest Agent in Pakistan Please feel free to contact us for Further Discussion and cooperation.

Regards

Jawed Rasool

I J Logistics International Pakistan

Office No: 11 First Floor Puri house West Wharf Road Karachi Pakistan

Tel 9221-32310169 / 32201867 / 32205034 Fax (221-32200012

email: Jawed.Rasool@ijlogistics.com.pk & ijlogistics@gmail.com

Mobile / Whatsaap 92-333-2322516

Wechat: ijlogistics Skype: Jawed.Rasool1

Hi, this side Mary from AMB. Hope you will fine. We provide pick up & delivery services to and from all ports in all over US. We handle all loads like as FTL, OTR, Drayage, and Dray van, Reefer, Hazmat and Ocean also. So If possible is there any load for this week or next week? Then let me know your email id and I send you my company details. I can provide you very best and competitive rates. I give my email mary.jane@amblogistic.us . Please get in touch with us for any such requirements. Thank you so much. Have a nice day.

Hi, this side Mary from AMB. Hope you will fine. We provide pick up & delivery services to and from all ports in US. We handle all loads like as FTL, OTR, Drayage, and Dray van, Reefer, Hazmat and Ocean also. So If possible is there any load for this week or next week? Then let me know your email id and I send you my company details. I can provide you very best and competitive rates. I give my email mary.jane@amblogistic.us . Please get in touch with us for any such requirements. Thank you so much. Have a nice day.

Hi, this side Mary from AMB. Hope you will fine. We provide pick up & delivery services to and from all ports in all over US. We handle all loads like as FTL, OTR, Drayage, and Dray van, Reefer, Hazmat and Ocean also. So If possible is there any load for this week or next week? Then let me know your email id and I send you my company details. I can provide you very best and competitive rates. I give my email mary.jane@amblogistic.us . Please get in touch with us for any such requirements. Thank you so much. Have a nice day.

Global shipping supplier South China

全球航運供應商華南區

Main line: Southeast Asia, Northeast Asia, Asia. The Middle East, India and Pakistan, Africa, the Red Sea. And ocean-going popular routes.

主線:東南亞,東北亞,亞洲。中東,印巴,非洲,紅海。還有遠洋熱門航線

Start to undertake southeast Asia to the global cargo booking, customs clearance, consignment services

承接東南亞到全球的貨物訂艙、清關、託運服務

Cargo stowage, transportation and booking services for imported materials from China

进口中国的物资配载运输订舱服务

Net receive goods, welcome to win-win cooperation, 24 hours online

全网收貨,歡迎合作共贏, 24 小時在線

Enquiries can be called: 18814460867 BERNIE

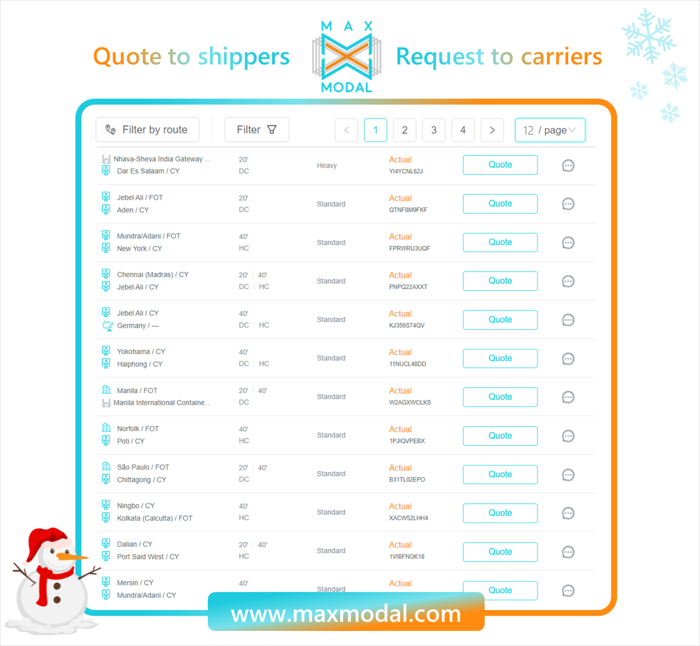

These are just a few examples of new requests of clients from across the world. To get more fresh inquiries and\or best quotes click here or push the «request management» button in the left menu.

Hi, this side Mary from AMB. Hope you will fine. We provide pick up & delivery services to and from all ports in all over US. We handle all loads like as FTL, OTR, Drayage, and Dray van, Reefer, Hazmat and Ocean also. So If possible is there any load for this week or next week? Then let me know your email id and I send you my company details. I can provide you very best and competitive rates. I give my email mary.jane@amblogistic.us . Please get in touch with us for any such requirements. Thank you so much. Have a nice day.

we I J Logistics International Pakistan which was Founded In Jan 2003, In the Field of Air Sea Freight Forwarding ,Total Logistics , Shipping , NVOCC Services with DDP DDU Custom Clearance Services, export /Import Nomination Destination Handing Agent Services, Project Cargo Services, Bonded & Non Bonded Transportation to all Pakistan and Transshipment to Afghanistan . if any one looking for strong and Honest Agent in Pakistan Please feel free to contact us for Further Discussion and cooperation.

Regards

Jawed Rasool

I J Logistics International Pakistan

Office No: 11 First Floor Puri house West Wharf Road Karachi Pakistan

Tel 9221-32310169 / 32201867 / 32205034 Fax (221-32200012

email: Jawed.Rasool@ijlogistics.com.pk & ijlogistics@gmail.com

Mobile / Whatsaap 92-333-2322516

Wechat: ijlogistics Skype: Jawed.Rasool1

A British academic is warning that this week could be disastrous for rail freight in the UK. The first week in January is normally quiet on the British railway scene, but this one will be even quieter than usual. Commuter trains tend to be much quieter, and there is some planned reduction in freight operations, together with a handful of engineering works to tidy up. However, 2023 starts where 2022 left off, with the country in the grip of widespread industrial action keeping trains off the rails.

A series of national strikes have been organised by the trades unions RMT and Aslef, lasting throughout the first week of 2023. That means there will be precious few passenger services in England, with some disruption in Scotland and Wales too. Despite not being directly involved, freight services across Great Britain will be affected as staff walk out from Network Rail signalling and safety roles. That’s an issue taken up by Dr Kamran Mahroof, an academic with a track record in the railway industry.

Threatening momentum

Speaking to the regional daily newspaper, The Yorkshire Post, Doctor Kamran Mahroof from the university of Bradford University argues that the bitter round of rail strikes threatens the momentum behind rail freight. The professor in supply chain analytics at the Yorkshire university says that the overlooked and under-appreciated rail freight network is in danger of being the real casualty of the strikes.

The first week of January has been wiped out by strikes from two of the main rail unions. The largest union in the sector, the RMT (Rail, Maritime and Transport), is staging its biggest action yet. Members at locations all over Great Britain are staging two 48-hour strikes on 3-4 January and 6-7 January. Coupling with those strikes, on Thursday, 5 January, the drivers’ union, Aslef, historically known as the Associated Society of Locomotive Engineers and Firemen, will call out its members at fifteen passenger train operating companies based in England.

Rail freight as the preferred choice

Doctor Mahroof has voiced many of the fears being quietly expressed around the industry at large. “It helped keep food on our tables during the lockdown, it kept our NHS heroes protected with adequate PPE and prevented the country from coming to a standstill by delivering fuel supplies to our forecourts”, he said. “No, not a superhero with a cape, but our overlooked and under-appreciated rail freight network.”

we I J Logistics International Pakistan which was Founded In Jan 2003, In the Field of Air Sea Freight Forwarding ,Total Logistics , Shipping , NVOCC Services with DDP DDU Custom Clearance Services, export /Import Nomination Destination Handing Agent Services, Project Cargo Services, Bonded & Non Bonded Transportation to all Pakistan and Transshipment to Afghanistan . if any one looking for strong and Honest Agent in Pakistan Please feel free to contact us for Further Discussion and cooperation.

Regards

Jawed Rasool

I J Logistics International Pakistan

Office No: 11 First Floor Puri house West Wharf Road Karachi Pakistan

Tel 9221-32310169 / 32201867 / 32205034 Fax (221-32200012

email: Jawed.Rasool@ijlogistics.com.pk & ijlogistics@gmail.com

Mobile / Whatsaap 92-333-2322516

Wechat: ijlogistics Skype: Jawed.Rasool1

2022 has seen it all. Elsewhere, the world seems to have come apart, but Britain has not had its problems to seek either. For a reflection of the good, the bad and the ugly of this country’s wild west of a year, look no further than the railways. Everything has happened, everything has been promised, and often nothing has happened at all. Then everyone started falling out with each other.

Britain’s troubles may seem trivial in global terms, but it has been a year with plenty to celebrate, plenty to exasperate, and plenty to leave observers just shaking their heads in disbelief. If, at times, it seemed like only a matter of time before a gang of banditos rode up, guns blazing, and hijacked a train, then perhaps it’s just as well 2022 was not a leap year. One more day, and we may all have been riding off into the wild west sunset on a rail replacement posse.

Good water, water, everywhere

It’s good to be wet. Not because of the floods that beset the Scottish summer, but finally, after ten years in the planning, Highland Spring got their terminal. The familiar mineral water brand may have suffered from the economic downturn, but that didn’t derail the long and ultimately successful opening of their rail terminal in rural Stirlingshire.

A modest affair, the two-track terminal finally opened after a ten-year hiatus. The invigoration of rail freight in 2022 often did not rely on bold projects and vast farms of warehousing. The tracks at Blackford village laid the way for successful timber trials from makeshift line side locations, as far separated as the north of Scotland, the heart of Wales, and the southwest of England.

Still on the waterfront

Down on the docksides, Salford remains something of a pipe dream, but the Port of Sunderland reactivated rail, and Aberdeen entered into long-term harbour development that may yet see a significant uplift in rail freight activity – albeit still restricted by gauge clearance issues. English freeport legislation is set to boost several ports and their rail freight operations. The recently inaugurated London Gateway and Southampton flow is surely just the start.

Freight train on the quayside in front of ship at Sunderland

The south coast also benefitted from infrastructure enhancement, and work continues on the East Coast digital project. The major works of East West Rail, and of course, HS2, continued to provide plenty of work for rail freight operations. The movement of bulk materials proves that there is life beyond barging boxes around the country. Intermodal continues to be the backbone of operations, but the wholesale modal shift, so often enthused by governments, has yet to manifest itself.

Bad for industrial unrest

In a year that threatened to become open warfare between the unions and governments (particularly Westminster), the rail freight sector maintained a broadly peaceful coexistence with the workforce. As far as the public has been concerned, however, the railways have been all about strikes. The growing intransigence on each side makes this a story that will spill over far into next year.

Birds eye view of the town of Leven in Scotland

More optimistically, the rail freight industry has been at the forefront of alternative and forward thinking. Alternative fuels, alternative working and embracing economic practice have all been on the agenda in 2022. The disappointing gap between government thinking and government doing has left many in the industry scratching their heads. The espoused demands of a net-zero economy by 2050 (2045 in Scotland) seem undermined by a still vast programme of road building and improvements, while government rail freight development is restricted to the tiny appendages agreed in the “Reversing Beeching” programme.

Don’t look bad in anger

HS2 continues to eat up the coffers and the countryside – more so the money, less so the fields – though both bring argument and confrontation. Rail freight operations continue to increase in what is, by most measures, Europe’s greatest civil engineering project. Rail freight will also support the construction of “Reversing Beeching” – a grand name for a peripheral project that hardly makes a headshunt of doing what the railways have always done – turning freight lines into mixed traffic to boost profits. Up for reinstatement is a few miles at Fawley (Southampton), and a length of the line at Leven in Scotland (not actually part of the scheme) come to mind as the only significant reopenings mentioned this year.

HS2 construction at Euston in London

The reign of Her Majesty The Queen came to an end. In the 70 years of the second Elizabethan age, half the network closed – even some useful bits, including the line along Royal Deeside, which her great-great-grandmother famously decreed should terminate some distance short of her Scottish castle at Balmoral. If not in the royal family’s backyard, then few could argue when the monarch’s subjects) refuse to accept new intermodal terminals at Motherwell, Northampton, St Albans and elsewhere. Perhaps 24/7 road trucking is considered a better alternative. It’s not just queens and kings of England who consider their home their castle.

Bad mishaps and missed deadlines

This year, the Derailment of the Year award goes to Carlisle. The northwest English town won by a country mile, thanks to the calamitous cacophony of cement wagons pouring down Petteril Bridge Junction and into the river below on 17 October, blocking multiple routes. The Settle and Carlisle Line put paid to heavy freight diagrams avoiding the West Coast Main Line – which retains its accolade as Europe’s busiest mixed traffic corridor. The loss of the Tyne Valley Route left both the WCML and its eastern counterpart without a handy diversionary for almost two months.

Aeriel view of the Petteril Bridge crash site showing Carlisle in background

2022 was not short of studies and reports. Just making the cut was the Scottish government Strategic Transport Projects Review 2 (long on pages, short on rail commitments). The Integrated Rail Plan for the North and Midlands is now available, albeit not necessarily from all good bookshops – but the industry still demands better clarity than that offered by the verbose document. No idea about the scope of Northern Powerhouse Rail? No, neither has the supply chain. As for such esoteric matters as Rail Network Enhancements Programme, or the Union Connectivity Review, the suggestion is “call back in 2023, probably.”

The ugly face of…

Grant Shapps may be off the transport secretary beat, and he has since been replaced – twice – but who can forget his hoodied videos for many an aggrandising project, including promoting the competition for the headquarters location for Great British Railways. From over forty valid applications, we are down to a final six, but it’s no longer the responsibility of the “man of the people”, Shapps. We’ve had almost as many changes of transport secretary in the past twelve months as we’ve had changes of franchise holder on the East Coast in the whole history of railway privatisation – and we used to think that changed hands too often.

Network Rail chair Peter Hendy and former transport secretary Grant Shapps leave the platform at London King's Cross

They do say politics is stardom for the less attractive, but there are limits. Since the departure of Shapps, the transition from Network Rail (everyone’s favourite infrastructure agency) to Great British Railways (a new infrastructure agency with most of the same people and even more responsibility) has gone remarkably smoothly. Well, insofar as it hasn’t gone anywhere yet.

Relations turning ugly

Now, in actual fact, Mick Lynch is quite a handsome chap, in a rugged sort of way. In a version of the old joke, when the leader of the RMT, the biggest rail union, hears a knock on his door, he asks who’s there. “The transport secretary”, comes the reply. “No, who is it really?” He may well ask. None of the secretaries of state incumbent at the Department for Transport has deigned to knock on his door in an effort to resolve the long-running and ever more bitter dispute, which has seen the railways grind to a halt with increasing frequency, culminating in a festive shut down almost as widespread and long-lasting as the closure of government offices over Christmas and New Year.

Sunset seen from Forth Bridge

At least, apart from the British economy, the only serious crash this year has been at Carlisle. The governments in Holyrood and Westminster still remain wedded to the motor car, despite espousing green credentials so obviously transparent that we would all have to be green in the ignorant sense of the word to believe their rhetoric will deliver the necessary radical modal shift to rail in anything like the measure needed to meet their net-zero ambitions. The devolved government in Cardiff escapes scrutiny for its published plans for rail development in the south of the principality and for the compromise resolution of the cross-border confrontation over access rights between Wrexham and Bidston. For political reasons, Northern Ireland remains without a government – but also for unclear reasons remains without a freight train in sight. There was talk of a bridge between there and Scotland to solve that, but that was put forward by some obscure political backbencher called Boris Johnson. Both the bridge and the backbencher have sunk without a trace. As for Grant Shapps and his hoodie videos – please, just arrest him.

Hi, this side Mary from AMB. Hope you will fine. We provide pick up & delivery services to and from all ports in all over US. We handle all loads like as FTL, OTR, Drayage, and Dray van, Reefer, Hazmat and Ocean also. So If possible is there any load for this week or next week? Then let me know your email id and I send you my company details. I can provide you very best and competitive rates. I give my email mary.jane@amblogistic.us . Please get in touch with us for any such requirements. Thank you so much. Have a nice day.

As 31 December approaches, and 2023 is peeking at us behind the New Year’s drop curtain, conversations at work, stores or even bars always entail a long sigh followed by the partially sad and partially joyful expression – ‘what a year it has been’. Indeed, most of us could relate to this end-of-year acknowledgement, which bears the weight of some hard months. The rail freight industry is no exception since it went through a lot -oh, this word again- challenges. Crises, a war and a pandemic were all amalgamated in 2022. Nevertheless, the industry might have gained more than it lost, but then again, this depends on one’s viewpoint.

RailFreight.com got in touch with four key industry players and asked them four questions to assess and sum up 2022 as a business year. How did companies look at it? Did they experience positive developments? What are their highlights for the old and wishes for the new year? RTSB, Rail Cargo Group, METRANS and T.H.I Logistics provided their input in this extensive interview.

Before you continue reading this article, the whole RailFreight.com team would like to wish a very happy New Year full of joy, light and success to you, your colleagues and your family!

If you could rate 2022 from one to ten in terms of success for the rail freight industry, how would you rate it? Could you explain why this grade?

RTSB: “The whole rail freight industry has been shaken this year. Several external effects, starting with an equipment shortage in early 2022, the late pandemic influences on the producing sector and surely the situation between Russia and Ukraine, forced our market to reinvent itself. Keeping all this in mind, we would rate this past year as quite successful and give it a solid 8.”

T.H.I Logistics: “2022 is a possible 7. Due to the conflict between Russia and Ukraine, many customers choose the Middle-corridor route as an alternative solution. However, it is less efficient than envisaged in meeting customers’ needs. Besides, another issue concerns the variety of Silk Road hubs in Europe that rail carriers wish to expand even more.”

Rail Cargo Group: “I would give it a 10 in terms of proving its systemic relevance, with the grain exports from Ukraine being the prime example. In terms of economic success, it is more like a 5. We managed the energy price increases well; however, in terms of volume, we’re slowly but surely gliding into a weaker economy,” commented the company’s CEO, Clemens Först.

METRANS: “2022 is a 5. The year could definitely be better. However, we are not down! We can and will do better. We can say that 2022 was the year of the “new normality” full of changes, full of challenges. Rail is facing an energy crisis, capacity issues, and many more troubles. These many problems in the background seriously impact the economic results and logistics and intermodal life, not only in METRANS. They reduce the competitiveness of the whole railway market, and we consider this point very important for this year and next year.”

In which sense was it better than 2021? Can you name some of positive developments?

Rail Cargo Group: “The year 2022 was in many aspects much worse than 2021 and even 2020, starting with a war raging in Europe. From a rail freight perspective, the entire sector faced many challenges. Apart from energy price increases and the pioneering task of exporting significant volumes out of Ukraine, other successful examples include securing the fuel supply for Austria after the accident in the only Austrian refinery Schwechat, which had a very high construction intensity and unseen volatility in maritime supply chains. Moreover, we expanded our business with new subsidiaries in China and Serbia, allowing us to expand our TransNET further. Finally, we have thoroughly prepared for the amendment of the Waste Management Act, which stipulates a gradual shift of waste transports from road to rail from 2023 on in Austria. However, all of this – and this is important for me to say – would not have been possible without our superb team. In 2022, I am personally very proud of the exceptional commitment and passion for rail freight shown by the great RCG team,” said Clemens Först.

METRANS: “One positive expectation we had for 2021 was the stabilisation after the pandemic. However, as quickly as stabilisation came, it was gone. If we could name some positive developments, these would include the ability to adapt our intermodal and rail products to the changing demand, and we have introduced new products. The most important new products concern those trains serving Istanbul and the port of Gdansk, the trains from Ukraine to Trieste PLT and the acquisition of the terminal in Malaszewicze. No matter what, we are sticking to the plan.”

RTSB: “2021 was a wild year for our industry. However, we were able to largely enhance the quality of our products, which is so important from a marketing and customer service perspective. It also became easier to promote new gateways like the TMTM corridor, which is also a plus. One positive development for the industry is that the rail freight industry was able to become a steady competitor to the common means of transport, such as sea and air freight. However, we must be clear that we will fall behind without continuous development. This year has brought more growth than any other regarding new corridors, products or processes. We must strive to keep up this momentum to stay successful.”

T.H.I Logistics: “The transit time was better than in 2021, while we experienced deeper international cooperation reflected, for instance, on the launching of the train with a fixed timetable to Hamburg and Duisburg. This is probably the key highlight of the year, together with all the experience the industry gained through the challenges that occurred.”

What was your favourite (work-related) moment for you in 2022?

METRANS: “One of the greatest moments would be our score with acquiring our terminal in Malaszewicze, and every new connection to the METRANS network is for us a big moment. For example, new investments in the terminals, like a new gantry crane in Budapest, Ceska Trebova, and investments in Gadki/Poznan or Berlin, are big moments for us all the time, and we are happy to enjoy them.”

Rail Cargo Group: “Definitely, when we exported the millionth tonne of grain from Ukraine – not least because we also made an industry-leading contribution to supporting Ukraine.”

T.H.I Logistics: “It is not a specific moment, but the fact that despite the Russian-Ukrainian conflict affecting many international situations, many customers are still willing to trust the China-Europe train.”

RTSB: “One of the best moments was supporting our employees throughout these difficult times. Providing stability and certainty in challenging times gives a unique opportunity to grow together and form a strong mindset within the company, resulting in a common identity and allegiance.”

If you could send in one rail freight wish for 2023, what would it be?

T.H.I Logistics: “We hope that, with closer cooperation between governments, the China-Europe trains will run more smoothly; they will perform better in international logistics services, and more customers will trust and choose the CEB service.”

Rail Cargo Group: “We know that shifting freight transport to rail is the only way to reconcile ambitious climate targets with economic and transport growth. That is why I would like to see significant European measures to create framework conditions for the success of rail freight, such as guaranteed track capacity and a cap on traction electricity, so as not to prevent a modal shift to rail,” concluded Clemens Först.

RTSB: “Our wish for the upcoming year would be to reach the volumes from 2021 while sustaining the operational quality we delivered in 2022. Additionally, we obviously hope for some calmer and more peaceful times ahead. We think we are all ready for a less turbulent year or two.”

METRANS: “Free tracks without disruptions, lower and more stable prices for traction energy. Whether this is a wish or a dream, we don’t know. We wish everybody nice and peaceful holidays, and may the upcoming year, 2023, be healthy and prosperous and make all of us happy and satisfied.”

Hi, this side Mary from AMB. Hope you will fine. We provide pick up & delivery services to and from all ports in all over US. We handle all loads like as FTL, OTR, Drayage, and Dray van, Reefer, Hazmat and Ocean also. So If possible is there any load for this week or next week? Then let me know your email id and I send you my company details. I can provide you very best and competitive rates. I give my email mary.jane@amblogistic.us . Please get in touch with us for any such requirements. Thank you so much. Have a nice day.