hello

Hello, :-) we need freight rates to Karachi.

India: Mundra, Cochin, Navasheva, Tuticorin

Dubai: Jebel Ali

United States: Houston, Baltimore, Savannah, Charleston

Poland: Malvasiewicz, Lodz, Warsaw

Jordan: Aqaba

Mexico: Altamira

Brazil: Itapa, Suape, Salvador, Rio de Janeiro, Santos, Paranagua

Germany, Türkiye, Senegal, Egypt, Malaysia, Spain, Czech Republic

You can send me a work email or add WeChat or WhatsApp:

+86-16623828729

Here is the rate from China to riyadh to you:

1-shenzhen-riyadh 40hq carrier: Whl rate:USD4650 closing date:1.6 departing date:1.8 transit time: 25 days via dammam

2-Ningbo-riyadh 40hq Hmm 4400USD closing date:1.5 departing date:1.7 transit time: 28days via dammam

3-Shanghai-riyadh 40hq COSCO 4350USD closing date:1.4 departing date:1.6 transit time: 28days via dammam

MSC USD5000 closing date:1.10 departing date:1.12 transit time: 28days via dammam

4-tianjini,xingang-riyadh, USD3400/20gp. USD4950/40HQ carrier: MSC closing date:8th,jan, departing date;10th,jan transit time: 35days via dammam

5-qingdao-riyadh 40hq carrier: YML rate:USD5400 closing date:1.6 departing date:1.8 transit time: 30 days via dammam

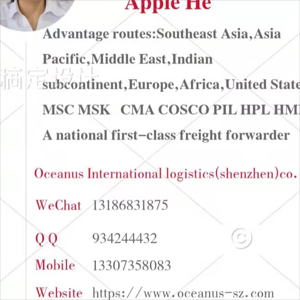

Warm Regards

Apple

Whatsapp:+86-133 0735 8083

Wechat:+86-131 8683 1875

E-mail:apple@oceanus-sz.com

#Export & Import # forwarder # Logistics#Trading company#foreign trade#China shipping#battery hashtag

Dear Berry,This is new to me and there are a lot of features I don't know yet

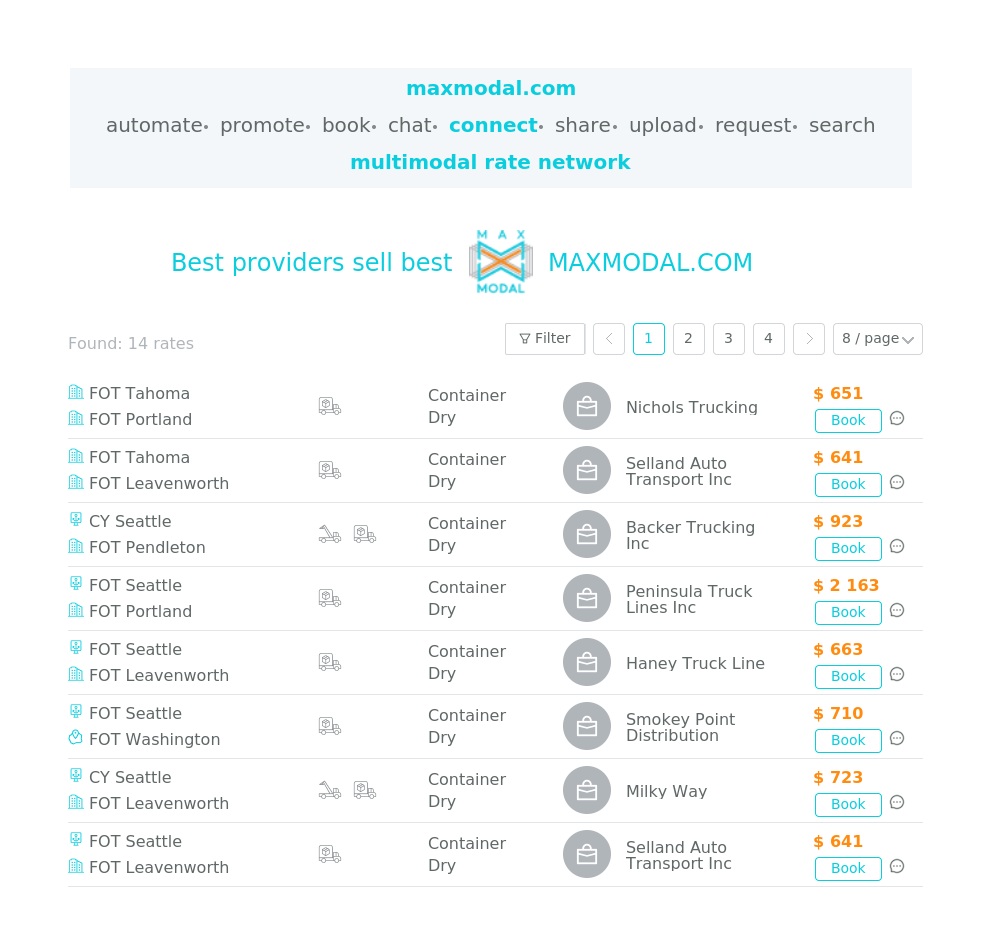

Hi, your freight rates are higher than those by ocean lines here https://cabinet.maxmodal.com/share/RSQNQSH8WV

East China’s economic powerhouse Shandong Province has handled 2,500 freight trains so far this year, compared with 2,057 trips in 2022.

On Tuesday, the 2,500th freight train of 2023, carrying 1,400 tonnes of appliances including air conditioners, freezers and water heaters, left the provincial capital Jinan for Tashkent, the capital of Uzbekistan.

According to Shandong Hi-Speed Group, the operator of the China-Europe railway freight service, four warehouses have been set up in Germany, Poland, Serbia and Uzbekistan to further promote the development of an overseas collection and distribution system and help companies reduce logistics costs.

In recent years, Shandong has launched special trains to transport cross-border e-commerce goods, vehicles, chemicals and tyres. According to the operator, the total number of customised special trains departing from the province has exceeded 200 by 2023.

Get the link for freight rates by many providers on maxmodal.com

Kami menawarkan Jasa Import Door To Door untuk memudahkan semua orang dalam kegiatan import.Kami juga menawarkan Borongan All-in untuk pengiriman FCL dan LCL,Serta Custom Clearance dan Undername.Kami juga mengkhususkan diri dalam mengimport barang textile,ballpres,barang bekas,mesin,sparepart,mobil bekas,motor bekas,produk kosmetik,alat berat,barang lartas,dan barang umum lainnya.

PT. BOSHOKU NUSA EXPRESS merupakan perusahaan ekpedisi barang yang terpercaya dan termurah.Kami mengkhususkan dari dalam dalam menyediakan layanan Door To Door dan Borongan yang sangat terjangkau murah dan efisien. Tim kami yang sudah profesional dan berpengalaman memastikan pengalaman yang lancar dan bebas dari kerumitan bagi semua klien kami untuk mengurus logistic dan bea cukai.Selain layanan import kami yang komprehensif kami juga menawarkan layanan khusus untuk Import dari Singapore,Seol Korea Selatan,Jepang,Malaysia,Tiongkok-China,Bangkok-Thailand,Hongkong,Taiwan,Australia,Canada,Jerman,Paris-France,India,Arab Saudi,Timur Tengah,London-Inggris,Usa-Amerika,Dan seluruh Negara ASIA & EROPA lainnya.Dengan komitmen terhadap kepuasan pelanggan kami dan jaringan Global yang sangat luas seluruh dunia.

PT. BOSHOKU NUSA EXPRESS adalah perusahaan CARGO LOGISTIC yang dapat menyelesaikan semua kebutuhan untuk proses IMPORT BARANG. Karna kami melayani pengiriman sampai kedepan tempat usaha anda yang ada diseluruh INDONESIA.

Mr. KITO

TELEPON : 02127843213

MOBILE : 085763772482

EMAIL : boshokukito@gmail.com

Kami menawarkan Jasa Import Door To Door untuk memudahkan semua orang dalam kegiatan import.Kami juga menawarkan Borongan All-in untuk pengiriman FCL dan LCL,Serta Custom Clearance dan Undername.Kami juga mengkhususkan diri dalam mengimport barang textile,ballpres,barang bekas,mesin,sparepart,mobil bekas,motor bekas,produk kosmetik,alat berat,barang lartas,dan barang umum lainnya.

PT. BOSHOKU NUSA EXPRESS merupakan perusahaan ekpedisi barang yang terpercaya dan termurah.Kami mengkhususkan dari dalam dalam menyediakan layanan Door To Door dan Borongan yang sangat terjangkau murah dan efisien. Tim kami yang sudah profesional dan berpengalaman memastikan pengalaman yang lancar dan bebas dari kerumitan bagi semua klien kami untuk mengurus logistic dan bea cukai.Selain layanan import kami yang komprehensif kami juga menawarkan layanan khusus untuk Import dari Singapore,Seol Korea Selatan,Jepang,Malaysia,Tiongkok-China,Bangkok-Thailand,Hongkong,Taiwan,Australia,Canada,Jerman,Paris-France,India,Arab Saudi,Timur Tengah,London-Inggris,Usa-Amerika,Dan seluruh Negara ASIA & EROPA lainnya.Dengan komitmen terhadap kepuasan pelanggan kami dan jaringan Global yang sangat luas seluruh dunia.

PT. BOSHOKU NUSA EXPRESS adalah perusahaan CARGO LOGISTIC yang dapat menyelesaikan semua kebutuhan untuk proses IMPORT BARANG. Karna kami melayani pengiriman sampai kedepan tempat usaha anda yang ada diseluruh INDONESIA.

Mr. KITO

TELEPON : 02127843213

MOBILE : 085763772482

EMAIL : boshokukito@gmail.com

Kami menawarkan Jasa Import Door To Door untuk memudahkan semua orang dalam kegiatan import.Kami juga menawarkan Borongan All-in untuk pengiriman FCL dan LCL,Serta Custom Clearance dan Undername.Kami juga mengkhususkan diri dalam mengimport barang textile,ballpres,barang bekas,mesin,sparepart,mobil bekas,motor bekas,produk kosmetik,alat berat,barang lartas,dan barang umum lainnya.

PT. BOSHOKU NUSA EXPRESS merupakan perusahaan ekpedisi barang yang terpercaya dan termurah.Kami mengkhususkan dari dalam dalam menyediakan layanan Door To Door dan Borongan yang sangat terjangkau murah dan efisien. Tim kami yang sudah profesional dan berpengalaman memastikan pengalaman yang lancar dan bebas dari kerumitan bagi semua klien kami untuk mengurus logistic dan bea cukai.Selain layanan import kami yang komprehensif kami juga menawarkan layanan khusus untuk Import dari Singapore,Seol Korea Selatan,Jepang,Malaysia,Tiongkok-China,Bangkok-Thailand,Hongkong,Taiwan,Australia,Canada,Jerman,Paris-France,India,Arab Saudi,Timur Tengah,London-Inggris,Usa-Amerika,Dan seluruh Negara ASIA & EROPA lainnya.Dengan komitmen terhadap kepuasan pelanggan kami dan jaringan Global yang sangat luas seluruh dunia.

PT. BOSHOKU NUSA EXPRESS adalah perusahaan CARGO LOGISTIC yang dapat menyelesaikan semua kebutuhan untuk proses IMPORT BARANG. Karna kami melayani pengiriman sampai kedepan tempat usaha anda yang ada diseluruh INDONESIA.

Mr. KITO

TELEPON : 02127843213

MOBILE : 085763772482

EMAIL : boshokukito@gmail.com

Yantian- Rotterdam, 40HQ,28th Dec cls SI,29th cls CY,USD2950,OOCL

Yantian-Hamburg,HMM, 40HQ,28th Dec cls SI,29th cls CY,USD2950,HMM

Warm Regards

Apple

Whatsapp:+86-133 0735 8083

Wechat:+86-131 8683 1875

E-mail:apple@oceanus-sz.com

#Export & Import # forwarder # Logistics#Trading company#foreign trade#China shipping#battery #freightforwarder #seafreight #airfreight

hi, Apple, carriers have better prices here than yours https://cabinet.maxmodal.com/share/DRRFLH2NG2