Good morning! I am Winni, a freight forwarder from China. I want to be your good helper in China. 😊

#freightforwarder #import #export #LCL #FCL #AIR

Since the beginning of this year, the China-Europe (Wuhan) freight train has made 696 trips, exceeding last year’s total of 155 trips. The number of arrivals and departures has increased significantly.

At present, the Wuhan freight train has expanded from three main categories of goods, including electronic components, display monitors and daily necessities, to 13 main categories of goods, including new energy vehicles, tea and epidemic prevention materials. The source of goods has gradually covered five pillar industries in Hubei Province, including information technology, automobile manufacturing, chemical and energy, general health and advanced agricultural products.

Starting from the city of Wuhan, 47 cross-border transport routes have been developed, covering 40 countries and 111 cities on the Eurasian continent, initially forming an international multimodal transport network linking Europe, Central Asia, Japan, South Korea and ASEAN countries.

The world’s largest container line, MSC, is joining in an alliance with tenth-ranked Zim across “multiple trades”, as both carriers prepare for life outside their cooperation with Maersk within the 2M Alliance.

The Israeli carrier said it had made “a new operational agreement with MSC, encompassing several trades”.

Zim explained: “The cooperation scope includes services connecting the Indian subcontinent with the east Mediterranean, the east Mediterranean with Northern Europe and services connecting East Asia with Oceania.”

It added that the agreements included vessel sharing, slot purchases and slot swap arrangements.

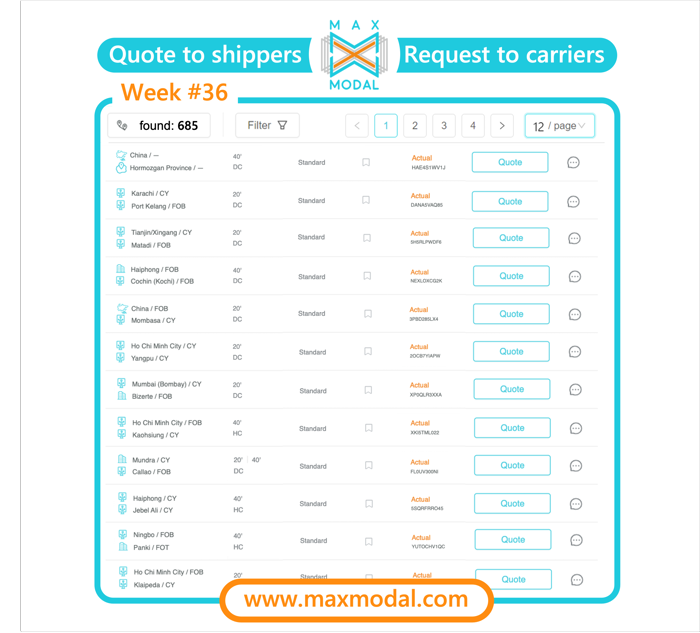

These are just a few examples of new requests at week #36. To get more fresh inquiries and\or the best quotes click here or push the «request management» button in the left menu.

I hope

Greetings of the day,

I hope you are doing well,

We would like to introduce ourselves as one of the leading transportation providers in the USA, MX & Canada. Our management team has significant experience of more than 25 years in Loading, hauling & transporting commercial goods. We specialize in Light & Heavy Freight, OTR, and Drayage work.

We want to set up with you as your trucking partner.

- What we cover:- "All states of the USA, MX, and Canada".

- What we specialize in:- "Dry vans, Flat and Open Bed Trailers, Intermodal, and Reefer Vans, Double Drop Trailers, Extendable Flat Beds, Box Trucks, Steering Dollies, and Power only, etc."

- What we have:- "7000 Grade 'A' Trucking Companies for freight services, Hold of more than 15,000 draymen, and a sister concern company with the name of Best Bay Trucking Corp. that owns 115 trucks"

- Our customers:- "Tesla Motors, DSV, Porche, Legier, and we are proudly serving over 700 customers across the USA and Canada"

I am looking forward to hearing from you for loads. Give us a try, we will give you the best.

Contact details,

augustus@bestbaylogistics.com // +1 9098439689

The Bay Area freight train arrives in Duisburg in 16 days, providing stable links between European countries and industrial centres in southern China

According to statistics from Shenzhen Customs, the China-Europe freight train “Bay Area” has made a total of 516 trips in the past three years, transporting 361,100 tonnes of goods with a cargo value of RMB 10.8 billion (USD 1.48 billion).

The Greater Bay Area (GBA) covers part of Guangdong Province and the Hong Kong and Macau Special Administrative Regions in southern China at the mouth of the Pearl River into the South China Sea. With cities such as Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen and Zhaoqing, the GBA includes some of China’s most economically powerful cities.

On 18 August 2020, the first train of “Bay Area” departed from Shenzhen Pinghu Logistics Hub to Duisburg, Germany. On 18 August this year, the “Bay Area” China-Europe freight train loaded with microwave ovens, electric ovens, electric sockets and other goods left for Central and Eastern Europe. The goods will arrive in Duisburg, Germany, in 16 days, saving about 15 days of transport time compared to traditional sea transport.

Over the past three years, the number of trips made by the China-Europe “Bay Area” freight train has increased year on year. The logistics service continues to expand, with routes covering Germany, France, Italy, Belarus and other 41 countries. It has become an important trade and transport corridor, closely linking the countries along the route with the Guangdong-Hong Kong-Macau Bay Area.

In recent years, the export product categories of “Made in Bay Area” continue to enrich. In addition to home appliances, garments, footwear and hats and other traditional products, exports of electronic equipment, machinery and equipment, new energy vehicles, fuel vehicles and other high value-added products have also shown significant growth.

Get ready to share your freight rates with the world with new advanced features coming

PEK-SIN BY SQ AIR FREIGHT

Delivery completed 🌹

If you also need a Chinese goods agent, please feel free to contact me.

Email:winni-cllcn@outlook.com

WhatsAPP:8618898311210

#freightforwarder #import #export #FCL #LCL #AIR