KTZ’s container transportation via its subsidiary KTZ Express has increased by 2,6 times year-on-year for the first half of 2023. The overall transportation amounted to 346.000 TEU. Cargo flows linked to China have contributed much to the growth.

According to KTZ, the growing volume is the result of three major transit routes development, namely China-Russia-China, China-Central Asia-China, and China-Belarus-China. Currently, only the Belarus route could link the EU countries directly, though this direct EU connection is rather insignificant.

This is not the case for the other two routes. China-Russia volumes are still growing; however, a possible downturn is on the horizon in the coming season. The China-Central Asia volumes, on the other hand, are showcasing the promising potential of the Middle Corridor with quite a few developments from Kazakhstan’s side.

Kazakhstan in Middle Corridor

On the west side of the Middle Corridor, Kazakhstan has formed a joint venture with Georgia to construct a new multimodal terminal in the port of Poti. The terminal could create a yearly potential maximum capacity of 450,000 TEU. On the side of the Caspian Sea, AD Ports Group from UAE has recently shown their interest in building a grain terminal at Kuryk Port with Kazakhstan infrastructure investment company, Semurg. Further to the east, KTZ is currently constructing its first terminal in Xi’an, China. The terminal is designed to serve mostly for product exporting from Kazakhstan to China. None of them has been finalised, but they could make this the Middle Corridor blueprint a bit more promising.

Thank customers and friends for their trust and support,

If you need a Chinese freight forwarder, maybe I can be a good helper.

#freightforwarder #FCL #LCL #AIR

We NTC Logistics India [P] Limited is committed to be a globally acclaimed professional and innovative end-to-end logistics ( IMPORT /EXPORT/ CUSTOMS CLEARANCE / TRANSPORT) solutions provider with emphasis on quality, safety and timely delivery of services.

We are Looking for any query from you about Import/ Export from any overseas to INDIA and INDIA to any overseas

Mr. Shamshad Ali

Mob no. +91-9720105691

Email id : impces.del@ntcgroup.in

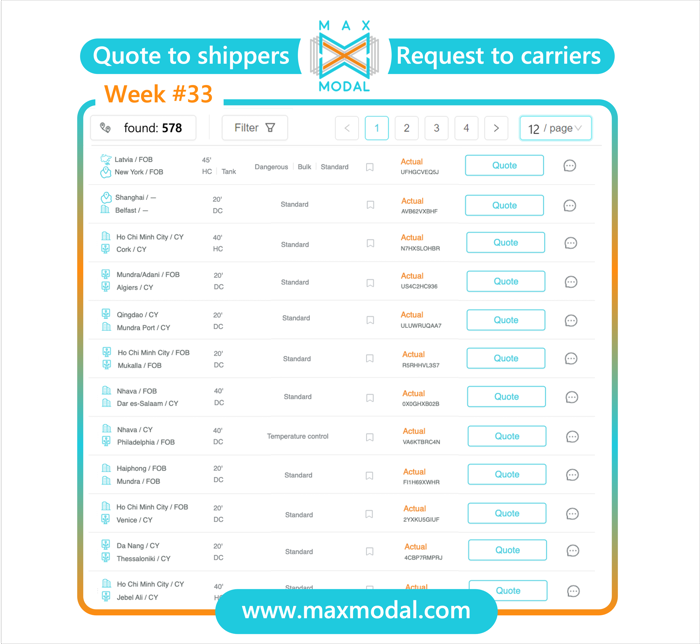

These are just a few examples of new requests at week #33. To get more fresh inquiries and\or the best quotes click here or push the «request management» button in the left menu.

Do you often struggle with busy work and occasionally make mistakes?

Research shows that productive work is focused work and taking a break, rather than always working.

How do you handle your work and rest?

Below some interesting picture sharing.

nice joke ))

We have received the picture sent by the warehouse. The customer's goods have been put into the warehouse. If you also need sea, air or express services, I can be your right-hand man in China, as long as you give me the opportunity.

#freightforwarder #import #export #ocean #air

Monday is a vibrant day, let's continue to refueling, if you have import and export business from China, please feel free to contact me.

Stenn International is happy to present its funding solutions for SME clients around the world.

Solve the issue with working capital by funding your invoices with Stenn.

Inconvenient payment terms won't become a problem for You and your clients anymore.

Learn more about Stenn services and apply for funding today!

Recently, a China-Europe freight train loaded with 50 container photovoltaic modules produced by LONGi Green Energy departed from Xi’an International Port Station and headed west towards Tashkent, the capital of Uzbekistan.The train will leave the country through the port of Khorgos and is expected to arrive in Tashkent, Uzbekistan in 12 days.

It is understood that the photovoltaic modules delivered this time are the first batch of products for the 1GW photovoltaic project in Uzbekistan.

The construction of 1GW project in Uzbekistan was signed during the visit of the Uzbekistan Energy Minister to China and currently is the largest PV project invested by Chinese enterprises overseas. According to the agreement, China Energy Engineering Corporation (CEEC) will build two 500MW solar power plant in Uzbekistan’s Qashqadaryo and Buxoro regions.

As the most reliable and intimate partner of China Energy Engineering Corporation (CEEC), LONGi successfully won the bid and will exclusive supply all the 1GW PV modules. As the largest overseas N-type PV plant, the 1GW project in Uzbekistan will adopt LONGi’s latest product Hi-MO 7 and all PV modules will be successively transported via China-Europe freight train (Xi’an) in 60th shipments with 3,000 containers. When put into operation, it is expected to generate 2.3 billion kWh of electricity annually, reducing natural gas consumption by about 588 cubic meters per year.

From January to July this year, China-Europe freight train (Xi’an) operated 3,045 trains, up 37.3% year on year, and the total weight of goods transported was 2.74 million tonnes, up 47.7% year on year.