Labour unrest at the port of Rotterdam has exposed long-standing issues and diminishing hopes of a resolution to backlogs and congestion in the near term.

Maersk told customers yesterday it would be omitting a call at the Hutchinson Port Delta II terminal on Monday, because of “unplanned strike action” at the facility.

Workers represented by the FNV Havens and CNV unions have been locked in dispute with the Chinese terminal operator since the second half of last year over port automation concerns.

The latest strike action began on Sunday and ended yesterday, and reports claim Hutchison has been forced to close the terminal gates due to overcrowding.

Contract negotiations began in November but hit a wall, with further strikes threatened until agreement is reached, and while Maersk told customers it would “continue to monitor the situation,” hopes of a quick resolution are fading.

The Halifax Port Authority was awarded funding up to CA$22.5 million (US$15.7 million) from Transport Canada through the Green Shipping Corridor Program to prepare the port for the fuels and energy sources of the future.

Major funded project activities for the port of Halifax include completing a risk assessment for hosting alternative-fuelled vessels, working with partners to support electrification efforts, investing in equipment to continue lowering emissions, developing the workforce, exploring lower carbon fuels including hydrogen, and planning for the future by doing foundational work in a series of risk and commercial feasibility studies.

"This is an important project supporting the future of the Port and our competitiveness," said Fulvio Fracassi, President and CEO of the Halifax Port Authority. "As the global shipping industry continues to take steps to decarbonize, we need to be prepared for the transition."

The funding builds on existing work at the Port of Halifax including the Memorandum of Understanding (MoU) with the Port of Hamburg. The Canadian port said it will share next steps and updates as activities take place.

India’s government is considering setting up a dedicated container shipping line to ease local shippers from an over-dependence on foreign-flagged carriers.

The new entity is expected to be named Bharat Container Line, and feature equity participation from public and private organisations.

According to reports, some 100 containerships will be procured or chartered for the new venture.

The move ties in with an ambitious $3bn “maritime development fund” New Delhi has announced as part of its annual budget for the fiscal year 2025-26, which “will directly benefit in financing for ship acquisition”, according to India’s shipping ministry.

“It aims at boosting India-flagged ships’ share in the global cargo volume by up to 20% by 2047,” it added.

Indian policymakers had been under tremendous pressure from exporters and industry groups to rein-in foreign lines exploiting supply chain disruption by charging high freight rates and other surcharges on Indian cargo.

The Federation of Indian Export Organisations (FIEO), at the vanguard of that push, persistently called for India-registered tonnage participation in major trade routes, in order to make domestic goods more competitive in international markets.

“A 25% [market] share by an Indian shipping line can save $50bn a year, and will also reduce arm-twisting by foreign shipping lines on medium and small businesses,” the export group had told the government.

FIEO president Ashwani Kumar last week welcomed the new budget proposals, which he called “a series of strategic initiatives aimed at bolstering India’s foreign trade sector, especially exports”.

“It will also help the country in saving a huge amount of foreign exchange remitted in the US dollar to foreign shipping lines,” he added.

Meanwhile, responding to the constant appeals, Shipping Corporation of India (SCI), the country’s only long-haul carrier, recently unveiled plans to add more box ships to its severely depleted fleet.

But with the global container shipping industry navigating some volatile conditions, some experts have expressed scepticism over the government plans.

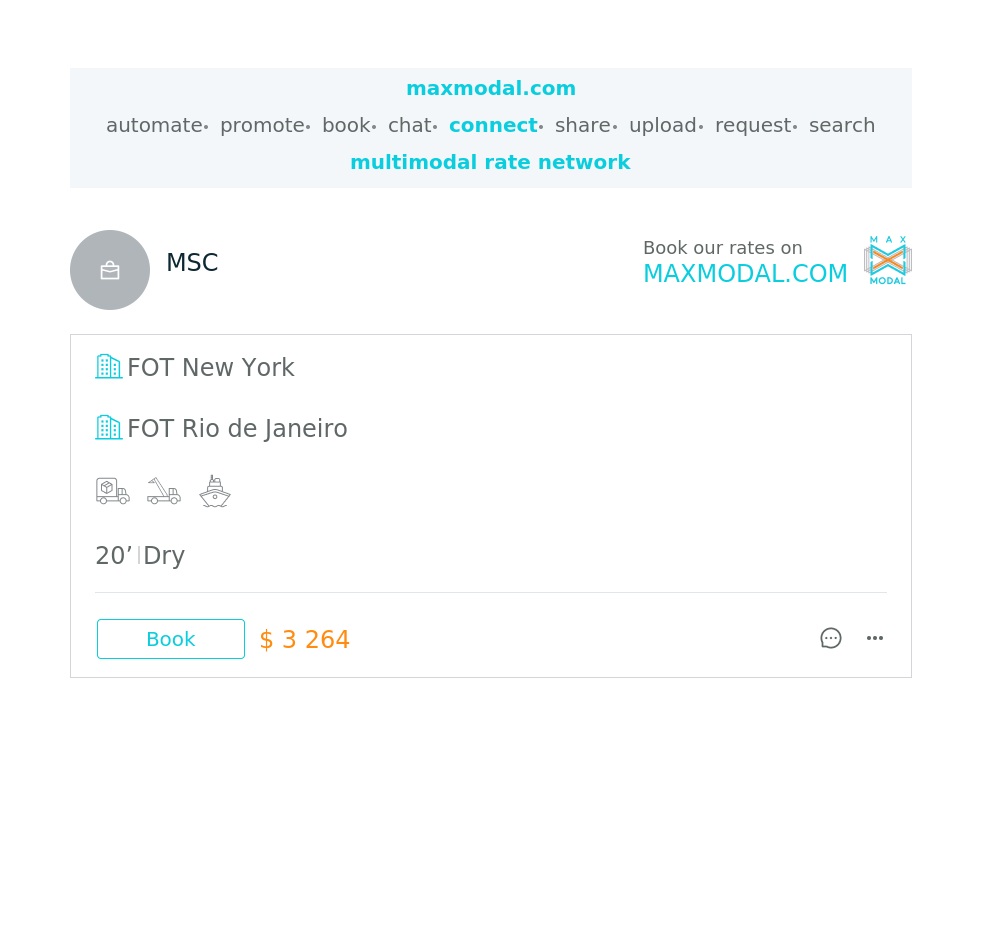

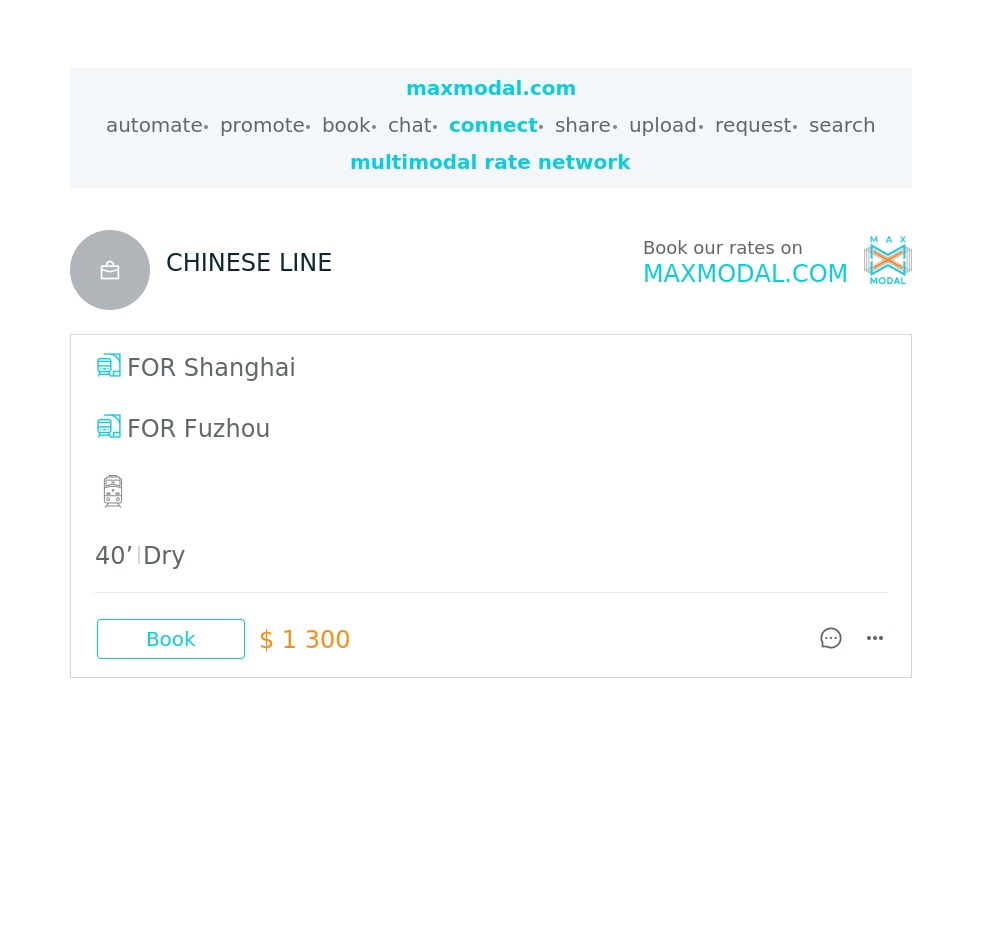

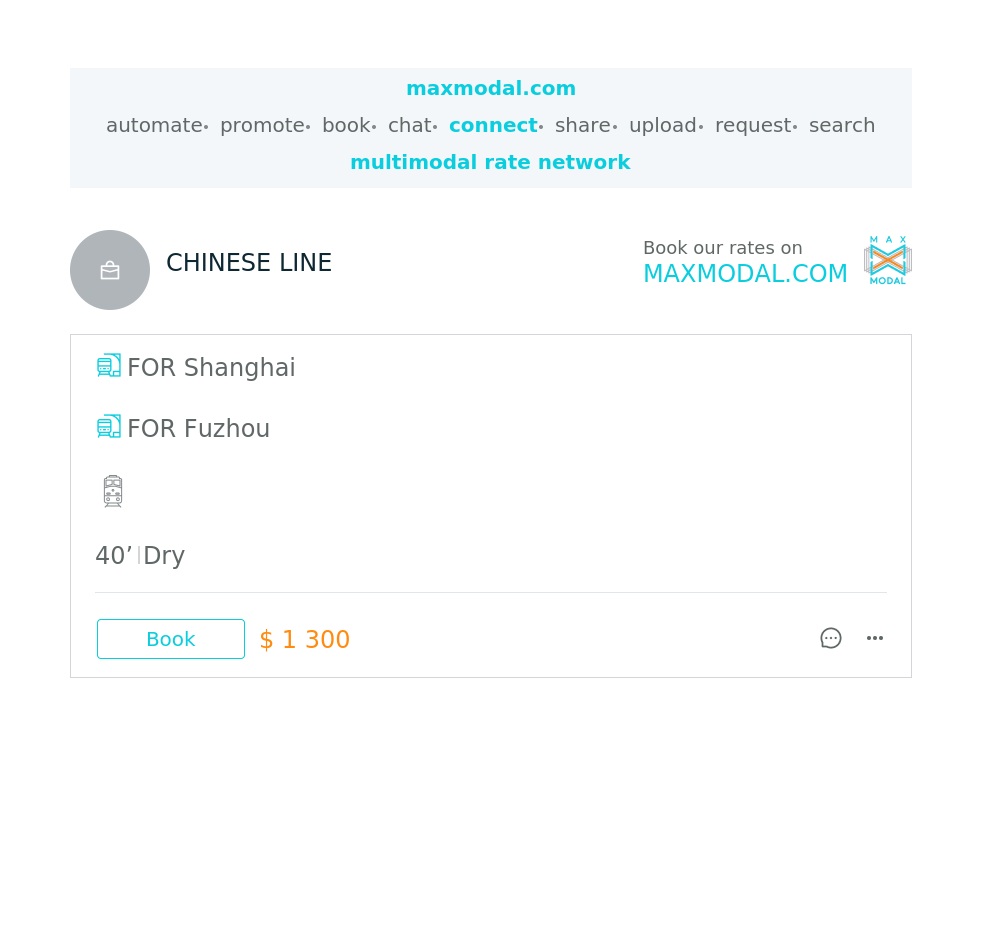

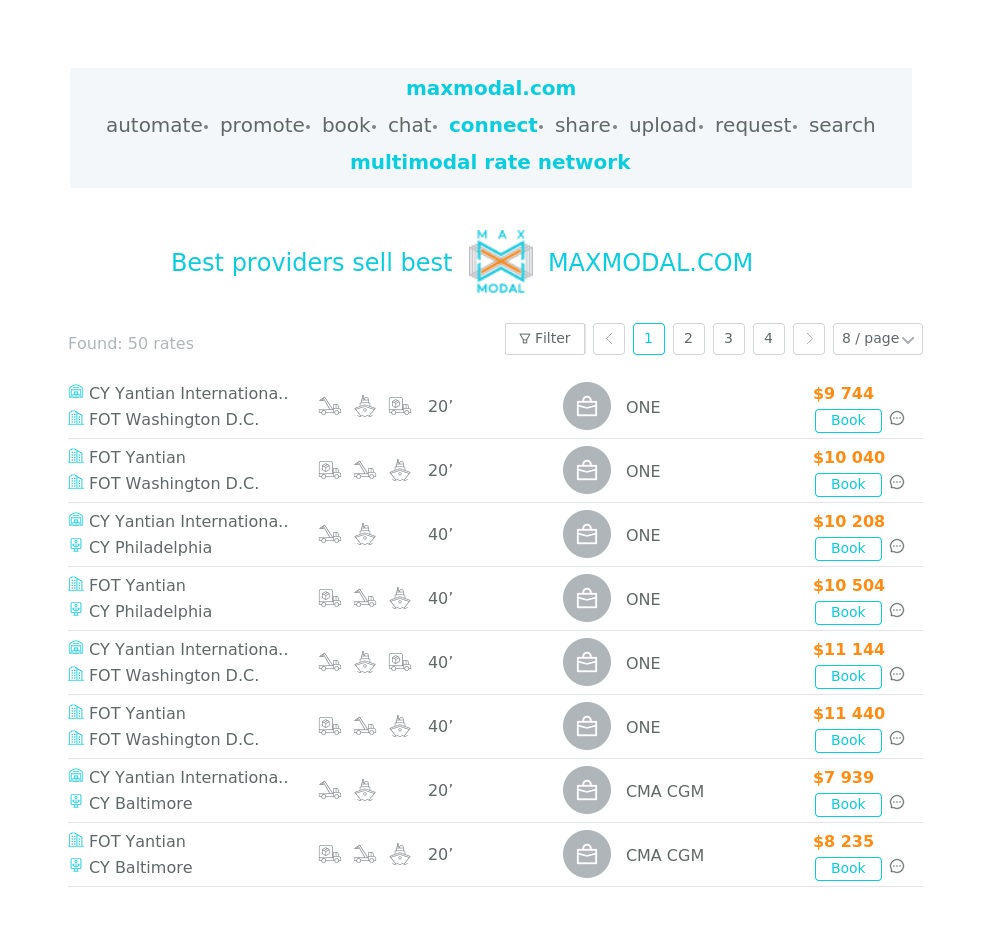

Get the link for freight rates by many providers on maxmodal.com

India is attempting to “play hardball” to become an alternative shipbuilding market, amid the trade diversification that has already yielded it some tangible gains on electronics manufacturing.

New Delhi’s latest federal budget, for fiscal year 2025-26, presented on Saturday, announced a host of measures to encourage investment in shipbuilding.

They include government approving a proposal to develop mega-shipbuilding clusters in the country, and earmarking some $700m to help existing yards enhance their infrastructure.

The government has also extended a “shipbuilding financial assistance policy,” aimed at providing direct financial subsidies to Indian shipyards, with a higher allocation of some $2bn. This is meant to help Indian companies offset operational cost disadvantages while seeking to secure shipbuilding orders.

Additionally, basic customs duty exemptions on the import of shipbuilding materials have been extended for 10 years.

Shipping minister Sarbananda Sonowal said: “India’s maritime sector has witnessed significant progress since 2014, and with the latest announcements, we are confident that the shipbuilding industry will serve as a catalyst for economic growth.

“This holistic approach will not only support industry growth, but also position India as a global leader in shipbuilding and maritime innovation.”

In another significant move, India has approved setting up a mammoth $3bn Maritime Development Fund (MDF) to provide financing for ship acquisitions, in a bid to boost its sagging fleet presence in the ocean trade ecosystem. The government plans to contribute 49%, with the remainder coming from major port authorities and other public sector enterprises, as well as from the private sector.

The government believes the MDF could lay the path to boost the share of Indian flagged-ships in the global cargo sphere up to 20% by 2047, believing an “indigenous fleet will reduce dependability of foreign ships, improve balance of payment and secure strategic interests of the country”.

Shipping Corporation of India (SCI), India’s only long-haul operator, recently indicated plans to acquire more containerships to raise its service network profile, ostensibly responding to growing shipper concerns over high freight charges by foreign container lines which have a near-monopoly in the market.

Other notable takeaways from the 2025-26 budget included an extension of the tonnage tax scheme to vessels used on the inland waterway network, an incentive thus far only available for ocean-going ships.

Indian shipping industry stakeholders across the spectrum have welcomed the proposals, while continuing to push for further policy refinements.

“The MDF is a game-changer, signalling the government’s serious intent to make India a global hub for shipbuilding,” Vivek Merchant told (director at Swan Defence and Heavy Industries).

“The industry still needs policy reforms that encourage private sector participation and reduce dependency on imports for critical components,” he added.

Rizwan Soomar, DP World’s CEO and MD for the Middle East/North Africa/India Subcontinent, believes India has the potential to solidify its local production prowess with ongoing infrastructure development and policy reforms. Through shortsea shipping subsidiary Unifeeder, it has expanded its interests beyond terminal operations.

“The government’s commitment to inland water transport through the tonnage tax scheme will provide a more sustainable and cost-effective way of cargo movement,” said Mr Soomar.

Shashi Kiran Shetty, chairman of Mumbai-based cargo consol leader Allcargo Group, said while the new budget plans underscored a stronger intent to position India as a shipbuilding nation, it would require much more to catch up with global giants in the field, especially China.

Shippers are happy to pay more for capacity and pricing assurance, and would like to be “in the loop” with supply chain decision-making, delegates heard at this week’s World Cargo Summit in Bruges.

Jody Paulus, CEO of dangerous goods shipper Optitune, explained that as a seller, he must set prices and quantities for his clients around a year in advance of production – which creates a headache when factoring-in supply chain costs.

He told delegates” “What is very important for me is that I have to make my prices at least a year in advance, with shipment included. It’s very difficult to get some kind of price [from carriers or forwarders], yet I must deal with this in my price towards my client.

“I am not completely sure what I’m actually going to pay for a certain shipment at a certain time. The more insecurity, the less interesting it is to me.”

And Mr Paulus said he would be happy to pay top dollar for a reliable service.

“When we talk about profitability, for me, it might almost be worth it to pay a little bit more and have a guaranteed price and guaranteed availability that I can ship, rather than think it’s always the lowest possible price.”

Further, Mr Paulus said, shippers looked for a “customer-centric” supplier that would take care of unexpected changes to their supply chain.

“Treat me as a partner,” he said. “Think along with me, if you can. For instance, now I’m not only shipping to China, suddenly I’m shipping to Vietnam. That’s now two destinations, because of geopolitics and production changing. This means completely different requirements and documents.

“Who can help me with this, so that I know that my shipment really arrives? I’m looking, of course, at my partner. This is where I hope they say, ‘oh, we can do everything for you’. They can say, ‘but it will cost you a little bit more’, but at least I know that it will be done.”

Danita Waterfall-Brizzi, principal cargo and logistics consultant at Hospitio, pointed out that forwarders shouldn’t assume that their customer “knows as much as they do about moving freight”, and there was often no explanation or discussion about the options and challenges of going from A to B.

“If they actually know that we have to have ‘China plus one’, we have new ways of shipping… As a shipper, it sounds like you wouldn’t mind knowing some of those things,” she told Mr Paulus

“Not to do it on your own, but to understand the challenges, the timing, and then the pricing that’s involved.”

He agreed that “that kind of information for me would be crucial”, adding: “We all know the better the relationship you have with your client, the less likely they are to shop around for something else.

“If I have security that they are getting me there every single time, no problems, at a price I know and can accept, then I have very, very little incentive to look for something else.”

Ms Waterfall-Brizzi said freight forwarders “more than ever” had their work cut out to manage supply chains in a turbulent world and stay competitive.

“Being able to explain and work through regulations for countries, the customs needs, what paperwork, what is digitised and what’s not, would help,” she concluded.

Vietnam is gaining ground as an alternative to China, but there are warnings that too-rapid growth could provoke tariffs from the new US administration.

Speaking to the Freight Buyers’ Club podcast, Tektronik Industries’ VP for global logistics, Alan Mctaggart, said that in 2018 the company began moving some of its manufacturing base into the South-east Asian country during the previous Trump government.

He said despite China having been a “easy, easy, easy” country in which to operate, Vietnam had also become “a productive place” for the company and was working well.

Tektronik’s move south was precipitated by the more hostile approach to China Mr Trump’s first administration brought into the White House, an approach continued, albeit with calmer rhetoric, by President Biden.

Since 2016, Vietnam has made sizeable strides in manufacturing output and now finds itself below just China and Mexico in terms of its trade surplus with the US.

And Mr Mctaggart said he could see further growth for the country, noting that he expects outsourcing to continue, especially if China is hit with particularly high tariffs.

While this may prompt optimism for the South-east Asian countries that have been lining up as replacements for China, there are voices of caution in Vietnam.

One source told the Trump administration appeared more focused on trade deficits this time around, than what they largely considered to be his previous more sinophobic stance.

Consequently, referencing the huge trade deficit between the US and Vietnam, they said it was likely Vietnam, if not already in the US crosshairs, was certainly being scoped.

Drewry Shipping Consultants’ MD and head of its supply chain advisors, Philip Dammas, told Freight Buyers Club it was not impossible that Mr Trump would impose tariffs on the US’s three biggest suppliers – China, Mexico, and Vietnam.

However, he added that the early signs indicated that the “huge trade war” talked-up during the election campaign may be avoided.

“Based on the data today, it looks as if it’s going to be a bit more targeted and less disruptive for carriers and forwarders and shippers. So, we stick with our previous forecast that there will be a slow increase in demand this year,” said Mr Dammas.