Sure!

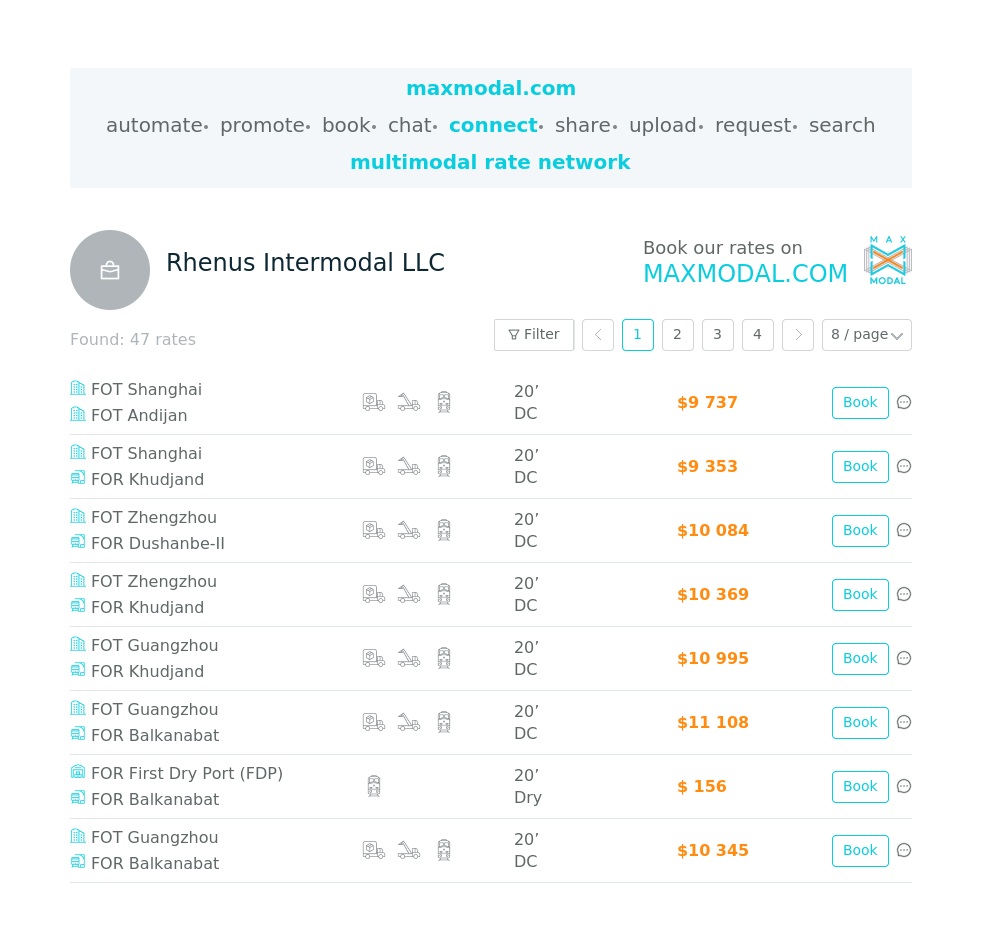

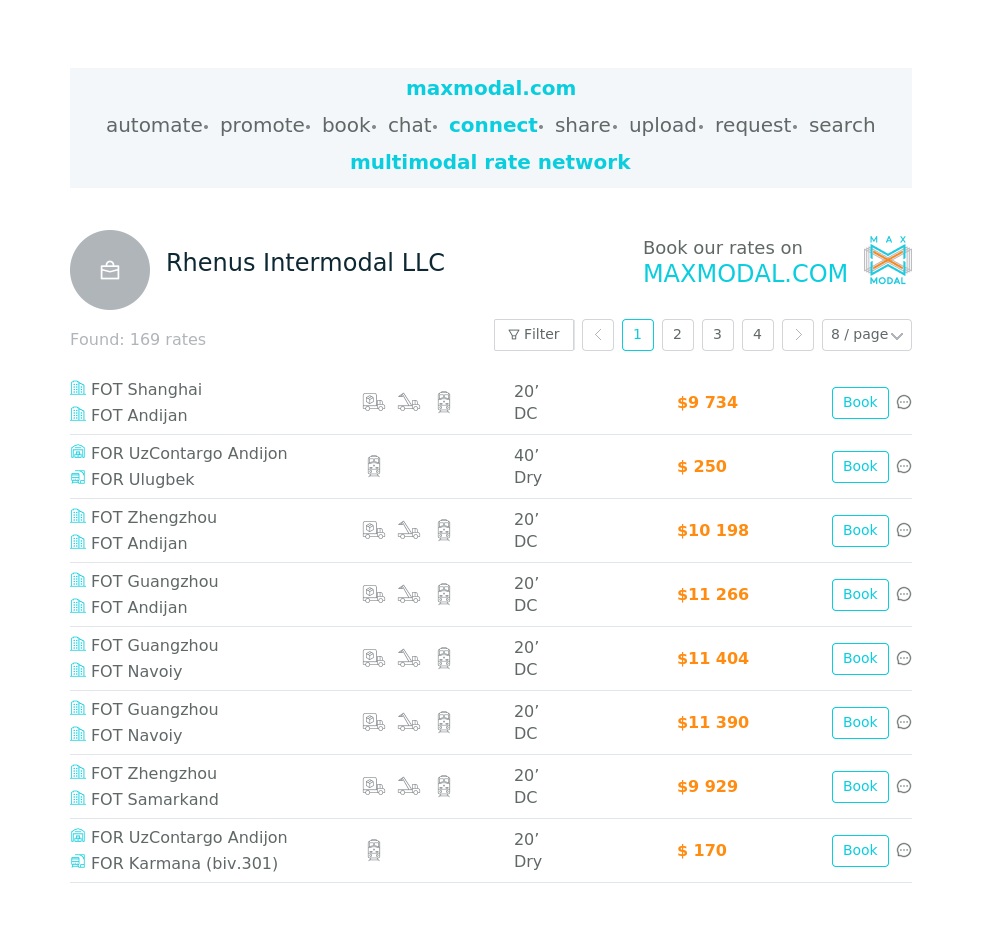

Great to see these rates by Rhenus Intermodal here

The Singapore-Rotterdam partnership has seen the first indications that its Green and Digital Shipping Corridor (GDSC) is coming to fruition, with shared bunkering procedures for methanol and bio-methane, and inter-port standardisation for port calls and electronic bills of lading (eBLs).

The two ports collaborate on matters of safety, such as bunkering procedures for new marine fuels, as well as in the digital aspect, adopting shared standards for eBLs and port call optimisation.

Recently at Rotterdam, Shell supplied 100 tonnes of mass-balanced liquefied bio-methane to CMA CGM Tivoli. The move illustrates the possibility of bunkering the now inordinately LNG-fuelled newbuild fleet with a cleaner, but chemically identical, form of LNG, derived from waste-based feedstocks.

Bio-methane, also known as bio-LNG, is generated using methane given off by landfill, sewage, and agricultural slurry, which is able to be harnessed as ship fuel. While bio-methane cannot deliver a 100% CO2 emissions reduction, as a fuel derived from anthropogenic sources of waste, it can help offset oil and gas extraction by harnessing a source of methane which existed at any rate.

The GDSC was established in 2022, when ‘green corridors’ were a relatively new concept. Since then, some 62 have been established.

“We have brought together 28 partners from across the whole value chain of shipping between Singapore and Rotterdam,” a port of Rotterdam spokesperson told. “It’s about defining the standards we can all follow to replace fossil fuels with sustainable fuels.

“These two ports are the number-one and -two bunkering ports in the world, so it’s logical they work together to find solutions.”

Without standardised definitions, ports have little prospect of performing the necessary data exchange and inter-port communication required to enable just-in-time arrival. For example, ports disagree on what is defined as ‘arrival’. This has spurred IMO action in respect of a Maritime Single Window (MSW), which would standardise these definitions.

“We also want to make shipping more efficient, that’s the digital part of it,” the spokesperson added. “So, for instance, when a ship knows exactly when it can make a port call, it can sail as efficiently as possible, reducing the use of fuel.”

One organisation tasked with defining these standards is the Digital Container Shipping Association (DCSA), the same entity that is standardising eBLs, which serve as another component of the GDSC.

Meanwhile, in February, Brazil signed a green corridors agreement with Norway, a trading partner for aluminium oxide, fish, fertilisers, and animal feed. Both countries benefit from sufficient hydro-electric generation to power the majority of their grids.

“We seek to build a sector that combines economic development and environmental responsibility, positioning Brazil as a reference on the global stage,” said Brazil’s minister of ports and airports, Silvio Costa Filho.

But of those 62 green corridors, just six have reached what the Global Maritime Forum describes as a ‘pre-commercial’ phase of development. On the other hand, initiatives such as the Nordic Roadmap, US-Republic of Korea corridors, and the Decatrip project are on hold, Global Maritime Forum notes in its 2024 annual progress report on green shipping corridors.

The Port of New York and New Jersey started 2025 with strong growth in total volume and imports.

In particular, the US port handled 720,747 TEUs in January, which represents an 8% increase compared to the same month last year. Imports showed a 10.5% growth over last January's numbers, totaling 378,632 TEUs, while exports reached 98,706 TEUs, translating to a 5.7% decrease.

Additionally, export empties increased by 11% in January, totaling 241,751 TEUs, and import empties tell by 15.1%.

Meanwhile, the Port of New York and New Jersey recorded a slight (1%) rail volume decline from last January's figure, totaling 52,487 containers, while the 23,241 autos that moved through the Port in January represented a 14.5% decrease compared to the previous year.

Wan Hai Lines GM Tommy Hsieh is positive about achieving higher transpacific contract rates this year.

Yesterday, following the unveiling of the Taiwanese operator’s 2024 results, Mr Hsieh said with the breakdown of the Israel-Hamas ceasefire, diversions round the Cape of Good Hope would continue.

He added: “Freight rates are lower today because demand is sluggish. As long as demand recovers, the shortage of shipping supply will still surface.

“Based on our discussions with customers, they can accept an upward adjustment of 20% to 30%.”

Wan Hai’s revenue rose 61% year on year, to $4.93bn last year, bringing a record $1.44bn net profit, following a $175.5m loss in 2023.

Drewry estimates container shipping supply will rise 4.9% this year, compared with 2.8% for cargo demand.

Mr Hsieh said: “The uncertainty of trade policies continues to affect the imports and exports between countries and regions. We will review movement in market demand to adjust our routes and vessel deployment.”

He also allayed concerns about US president Donald Trump’s plan to impose hefty port charges on operators with Chinese-built ships. Mr Hsieh said: “Just 10% of Wan Hai’s fleet was built in China, and these are mainly assigned to our intra-Asia services. The company does not deploy any Chinese-built ships on its transpacific services.”

He added that Wan Hai would take delivery of three 13,000 teu ships this year and will use these to expand its long-haul routes.

Between 2026 and 2030, Wan Hai will take delivery of 30 newbuildings, comprising eight of 16,000 teus, 20 at 8,700 teu, and two 7,000 teu ships, indicating the carrier’s bullishness on the long-term prospects.

However, none of these vessels is under construction in China, the orders being spread around shipyards in South Korea, Japan, and Taiwan’s CSBC.

MSC is flawlessly emulating dethroned rival Maersk’s old strategy by aggressively expanding its fleet and terminal network, according to Linerlytica analyst Tan Hua Joo.

Mr Tan was speaking at the Navigating the Volatility of Container Freight Rates conference in Singapore today.

As container freight rates rocketed to historical highs during Covid, MSC grew its fleet with newbuildings and second-hand vessels, while Maersk did the opposite, betting on an integrator strategy, reinventing itself as a comprehensive end-to-end logistics provider.

Mr Tan noted that with a fleet size exceeding 6.44m teu, MSC has built a large lead over Maersk, the former market leader’s fleet now just over 4.5m teu.

From having 80% of its fleet chartered, back in 2020, MSC’s ratio of chartered vessels now stands at 25% – the Swiss-Italian liner having increased its owned fleet to more than 400 ships.

Mr Tan said: “MSC is following the exact playbook Maersk used, which is to dominate the market, and it’s done it to perfection. Maersk has simply lost at its own game, because it’s not grown since its 2016 acquisition of Hamburg Süd.

“But what MSC is doing has also triggered a strategic response from the rest of the market, because CMA CGM, Cosco, Evergreen, and ONE can’t sit back and do nothing. Because, after all the record profits these carriers earned in these past years, they’re not going to sit on their cash pile. They’re going to spend it and build more ships, and go for this market growth narrative.”

Mr Tan said Maersk was paying a heavy price for its lack of fleet growth, as the Danish line’s Gemini alliance with Hapag-Lloyd was in a weak position, vis-à-vis its rivals in the transpacific space, with just 3m teu of capacity.

The rate of growth MSC has achieved is something completely unprecedented in the history of this industry, and this is going to drive a reaction from the rest of the market, including Maersk, he said.

Last week, The Loadstar reported that Maersk had temporarily increased its fleet to past the 4.5m teu mark, transcending its earlier announced cap of 4.3m teu.

This chase for market share, and very low demolition levels, is effectively perpetuating overcapacity, said Mr Tan, adding: “Everyone is doing the same thing. That’s going to drive a significant level of oversupply, the extent of which we’ve probably not seen before.”

He said that even as it was increasingly likely the Red Sea crisis would continue, it would be hard to avert a correction in freight rates this year.

High newbuilding orders and very low demolition numbers mean fleet growth would be 6%, if diversions continued round the Cape of Good Hope, and 15% if Suez Canal transits resumed.

The Valenciaport Statistical Bulletin reports a significant rise in container traffic with Angola, which surged by 2,200% in tonnes during the first two months of the year.

Trade with Israel also grew by 44.4%, while Algeria saw an increase of 18.7%. Meanwhile, China remains Valenciaport's top trading partner, with 129,724 TEUs exchanged during this period-a 36.44% increase-along with 1,410,867 tonnes of cargo, reflecting 29.43% growth.

The export sector continues to show positive momentum at the Spanish port, as full container cargo traffic leaving Valenciaport for international destinations increased by 5.4%. According to the February Statistical Bulletin, full TEU traffic grew by 9.9% that month. Unloading operations surged by 29.9%, and transit container movements rose by 4.15% in the cumulative total for January and February.

In the first two months of the year, companies operating through Valenciaport handled 12.51 million tonnes, marking $1.35% year-on-year increase. Container traffic reached

863,894 TEUs, reflecting a 10.3% growth.

The Bulletin's analysis also highlights a 0.44% rise in UTI (intermodal transport units) traffic, while TEU transport by rail grew by 4.53%. However, passenger traffic declined by 5.9%, and vehicle traffic dropped by 34.3%.

By sector, Valenciaport recorded growth in non-metallic minerals (28.08%), chemical products (12.17%), construction materials (9.06%), and agri-foodstuffs (2.35%) during the first two months of the year.

Carriers have been managing NVO [non-vessel operator] compliance “much more strictly” in the post-Covid market, forcing them “to revamp their whole sales structures”.

In the past few years’ ocean shipping contracting, carriers have increasingly been pushing “an almost pervasive use of weekly string or port by port pair allocation plans” to monitor NVO compliance, according to Bob Fredman, principal at SF Global Insights.

Mr Fredman explained to delegates at TPM25 by S&P Global that a carrier today says to a forwarder or NVO – ’you’re ready to sign the contract? Let’s agree on the allocation plan’.

He said: “It is no longer ‘5,000 feu, great, where do we sign, we’ll figure out the allocation plan later’. It’s like ‘five this week on this lane, and six this week on that lane’. That has allowed the carrier to manage NVO compliance much more strictly.”

Mr Fredman added that “if a couple of weeks in a row, you miss your five, it gives the carrier the opportunity to say ‘well, sorry, you only gave me two, the market’s strong, I’m only giving you [space for] two”.

He said this was one way carriers had been able to avoid holding space for long-term contracts, allowing them to improve yields in a more profitable spot market.

Indeed, Stephanie Loomis, head of ocean freight Americas at Rhenus Logistics, added that the biggest change in behaviour post-Covid was that carriers were “now really sort of forcing [NVOs] to give them a certain percentage of cargo on the spot market”.

She explained: “The biggest thing you argue about during your contract negotiations as an NVO, is how much of your allocation is going to be based on spot rates and how much of it is going to be based on more of a fixed rate.

“And as spot rates have remained so high since the pandemic, [carriers] are not disregarding that percentage that you have, but they’re definitely keeping a closer eye on it.

“If you don’t feed them a certain amount of spot business, your NAC [named account] business goes away; they just won’t give it to you. They either won’t fulfil that allocation or it’s a constant communication with them.”

Ms Loomis also told delegates carriers had become less interested in smaller volumes, which had “forced NVOs to revamp their whole sales structures”.

“When I first got in the business, it was not uncommon to see an importer with a few hundred, maybe even a thousand, teu capture a named account rate that was very close to what a large BCO would be paying, if they knew the market well enough.”

“Those days are gone, absolutely gone,” said Ms Loomis.

After last week’s hiatus, container spot freight rates on the Asia-Europe trades resumed their downward trajectory this week, with prices to both North Europe and Mediterranean ports falling.

The World Container Index (WCI) produced by Drewry, which quotes prices paid over the week, showed rates on the Shanghai-Rotterdam leg down by 5% week on week, to $2,512 per 40ft, as the effects of carriers’ 1 March FAK hikes wore off.

Spot rates on the leg are now some 28% below the same point last year, according to the WCI, and lower than the post-Chinese New Year and Golden Week pricing slumps last year.

Meanwhile, the WCI’s Shanghai-Genoa leg declined 11% week on week, to end at $3,333 per 40ft.

However, spot rate declines on both trades have occurred against a backdrop of relatively strong demand.

According to recently released figures from Container Trade Statistics (CTS), January saw 1.5m teu shipped from the Far East to Europe, an 18.2% increase in volumes over January 2024.

This implies that rising capacity on the trade is outpacing growth, leading to falling vessel utilisation levels, suggested Sea-Intelligence chief executive Alan Murphy.

“On Asia-Europe, utilisation at a monthly level dropped in January 2025, whereas this drop typically only begins after Chinese New Year.

“This is likely a part of the explanation for the early drop in spot rates on this tradelane in January,” he added.

Several carriers have now published new FAK rate levels for implementation on 1 April to arrest the declines. Both Hapag-Lloyd and MSC have set the new FAK rate at $4,000 per 40ft between the Far East and North Europe.

Meanwhile, expectations are that next week will show further declines.

Today’s Shanghai Containerised Freight Index (SCFI), which aggregates spot freight quotes for the forthcoming week, showed a 15% week-on-week decline in China-North Europe rates, and an 8% decline in China-Mediterranean pricing.

“On Asia-North America, there is a clear strengthening of utilisation in January. This trade also saw spot rates hold firm longer than in Asia-Europe, lending credence to the notion that lower utilisation is one of the drivers behind the early drop in Asia-Europe spot rates,” Mr Murphy explained.

However, spot rates continued to fall on the transpacific and Asia-US east coast trades this week. The WCI’s Shanghai-Los Angeles leg finished at $2,906 per 40ft, an 8% week-on-week drop, while the Shanghai-New York trades was down 7% week on week, to finish at $4,038 per 40ft.

Today’s SCFI points to further declines next week, with its US west coast leg down 14% and the east coast leg down 10%.

However, one silver lining for carriers is that backhaul rates may have found their floor, with the WCI’s Rotterdam-Shanghai leg up 1% week on week, to $490 per 40ft, and New York-Shanghai also up 1%, to 854 per 40ft.

These marginal increases have come despite some pretty poor volume data – CTS recorded January Europe-Far East volumes at 484,000 teu, 3.1% down year on year, while North America-Far East shipments were down 9.6% year on year, to 473,100 teu.

In contrast, the transatlantic trade had a robust January in terms of volumes – the headhaul Europe-North America route saw a 10.8% year-on-year gain to 495,000 teu, and the WCI’s Rotterdam-New York leg was up 1% week on week, to $2,373 per 40ft, despite a growing imbalance between demand and supply, which could affect rates in the next few weeks.

“On Europe-North America however, there was a sharp drop in utilisation in January, but curiously, without a major drop in spot rates – at least not yet,” Mr Murphy said.

“The transatlantic is a special animal, not subject to the “normal” market dynamics, but it can’t stay out of sync with supply/demand for too long, so we expect a serious downwards correction in the coming weeks/months,” he added.

US nuclear reactor developer TerraPower and South Korean shipbuilder HD Hyundai Heavy Industries (HHI) are to collaborate to construct small modular reactor-powered containerships.

The aim is to gain a competitive edge over Chinese shipbuilders and become an early mover on carbon-free ships.

The firms said on Tuesday they aimed to finalise development of marine SMR models by 2030 and then commercialise SMR-propelled boxships.

The collaboration comes three months after HHI signed an agreement to supply cylindrical reactor containers to TerraPower to produce sodium-cooled fast reactors.

Sodium reactors are expected to be key components of SMR-propelled containerships, which will run on nuclear power instead of fossil fuel. Mainline operators are said to be interested, as additional cargo can be loaded in the place of fuel cylinders and there is no worry about profitability deteriorating in the face of soaring oil prices.

HHI chief operating officer Kwang Shik-won said: “This agreement marks a transformative collaboration that will accelerate the commercial viability of next-generation nuclear energy solutions and help shape the future global energy landscape.”

Founded by Microsoft pioneer Bill Gates in 2008, TerraPower is building a 345-MW sodium-reactor demonstration project near Kemmerer in Wyoming. The facility, which will supply power to PacifiCorp’s electric grid, could begin operations by 2030.

The agreement coincides with the South Korean government’s plan to capitalise on US President Donald Trump’s protectionist moves against Chinese-built ships.

During a seminar organised by the Korea Shipowners’ Association yesterday, its chairman, Park Jung-seok, touched on the proposed Ships for America Act and Mr Trump’s plans to impose hefty port fees on calls by Chinese-built ships and their operators.

Mr Park said: “If South Korea thoroughly prepares and responds to the US policy, with our know-how, we will be able to turn the current situation into an opportunity.”