Rail:

FCL

FOB Tianjin - FOR Moscow - USD4900/40HQ - ETD: 22/03

FOB Qingdao - FOR Moscow - USD5200/40HQ - ETD: 22/03

FOB Shanghai - FOR Moscow - USD5350/40HQ - ETD: 23/03

FOB Ningbo - FOR Moscow - USD5550/40HQ - ETD: 23/03

FOB Shenzhen - FOR Moscow - USD5400/40HQ - ETD: 24/03

FOB Tianjin - FOR St. Petersburg - USD5400/40HQ - ETD: 25/03

FOB Qingdao - FOR St. Petersburg - USD5500/40HQ - ETD: 25/03

FOB Shanghai - FOR St. Petersburg - USD5690/40HQ - ETD: 25/03

FOB Ningbo - FOR St. Petersburg - USD5870/40HQ - ETD: 25/03

FOB Shenzhen - FOR St. Petersburg - USD5800/40HQ - ETD: 23/03

FOB Tianjin - FOR Minsk - USD6100/40HQ - ETD: 24/03

FOB Qingdao - FOR Minsk - USD5900/40HQ - ETD: 24/03

FOB Shanghai - FOR Minsk - USD5840/40HQ - ETD: 28/03

FOB Ningbo - FOR Minsk - USD5830/40HQ - ETD: 28/03

FOB Shenzhen - FOR Minsk - USD5950/40HQ - ETD: 24/03

FOB Tianjin - FOR Novosibirsk - USD4700/40HQ - ETD: 25/03

FOB Qingdao - FOR Novosibirsk - USD4700/40HQ - ETD: 25/03

FOB Shanghai - FOR Novosibirsk - USD4900/40HQ - ETD: 25/03

FOB Ningbo - FOR Novosibirsk - USD5150/40HQ - ETD: 25/03

FOB Shenzhen - FOR Novosibirsk - USD4950/40HQ - ETD: 23/03

...

Ekaterinburg/Irkutsk/Samara/Kazan/Nizhnekamsk/Togliatti/Ufa/Ulyan...consult with me individually.

Shekou-Jebel Ali 1125/1350

Shekou-Dammam 1175/1400

Shekou-Sohar 1100/****

Shekou-Salalah 1500/1950

Shekou-Jeddah 2400/2900

Shekou-Sokhna 2400/2900

Nansha-JEBEL ALI /HAMAD 1300/1550

Nansha-DAMMAN,USD1350/20GP

Nansha-RUH,USD1650/20GP

Nansha-AJAMN,USD1550/20GP

Nansha-SHARJAH,USD1650/20GP

From Guangdon,China to

Jeddah 3000/3100

Aqaba 3048/3500

Sokhn 3000/3500

Salalah 3040/3580

Tks $ Warm Regards,

Sales department

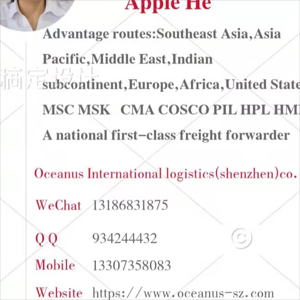

Apple

Oceanus International Logistics (shenzhen) Co.,Ltd

Add:333,Floor 3,New ACME Building,No.6 Zijing Road,Fbao Community,Fubao Street,Futian District,Shenzhen City

Wechat:+86-131 8683 1875

E-mail:apple@oceanus-sz.com

Website:www.oceanus-sz.com

NS-UMM Q 1535/1900USD+LOCAL

SK-UMM Q 1510/1850USD+LOCAL

Shantou-UMM Q 1620/2075USD+LOCAL 3.14 cls CY

Tks $ Warm Regards,

Sales department

Apple

Oceanus International Logistics (shenzhen) Co.,Ltd

Add:333,Floor 3,New ACME Building,No.6 Zijing Road,Fbao Community,Fubao Street,Futian District,Shenzhen City

Wechat:+86-131 8683 1875

E-mail:apple@oceanus-sz.com

Website:www.oceanus-sz.com

Tianjin-DAMMAM,20GP 2*40HQ

Carrier:MSC

Rate:$1710/2150

Schedule:ETD 3.20 DIR

Qingdao-DAMMAM,20GP 2*40HQ

Carrier:ESL

Schedule:ETD 3.17 DIR

Rate:$1650 / 1950

Qingdao-SHUWAIKH,20GP 2*40HQ

Carrier:MSC

Schedule:ETD Wednesday via Hamad T/T:about 33 days

Rate:$1870/2410 price valid until 3.17

The sale of DB Schenker, Deutsche Bahn’s logistics arm, might have found its suitor. Danish shipping giant DSV signed an agreement with two investment banks to gather enough funds to conclude the purchase. On the other hand, DHL officially withdrew from the race.

DSV is cooperating with French BNP Paribas and the British-Chinese credit institution HSBC to draft an acquisition offer, as various Danish media outlets mentioned. If DSV would end up taking over DB Schenker, it would become the world’s largest forwarder. One of the other possible buyers was DHL, which decided to continue with its strategy of bolt-on acquisition, which entails the purchase of smaller companies.

The sale process

Deutsche Bahn officially put DB Schenker up for sale in December 2023, after consulting with financial institutions throughout the past year. Their ears were open to offers between 19 December and 12 January. Dozens of parties showed their interest in taking over DB Schenker, which remains the most profitable asset of the DB Group. It now seems to be a clear frontrunner, DSV, but it is not yet quite clear how long the process will be.

German rail freight operator Kombiverkehr is launching a new service between Rotterdam and Cologne-Eifeltor. The service will run three times a week and is available for nearly all types of goods, except dangerous goods of class 7.

The new route will launch on 12 March and allows for intermodal transport with P400 loading units. It will run on Tuesdays, Thursdays and Saturdays in both directions. Trains will depart from the Rail Service Center in Rotterdam Waalhaven and take twelve hours to reach their destination at Cologne-Eifeltor. According to the company, all types of goods can be carried on the route, with the exception of class 7 dangerous goods.

Kombiverkehr stresses the interconnectivity of the route to other destinations. “This new train product shows how we are capitalising on our network advantage. Köln-Eifeltor is one of our biggest hub terminals in Germany, with many options for onward transport both nationally and internationally,” says the company’s Benelux Sales Manager.

The Cologne-Eifeltor hub is one of Kombiverkehr’s biggest, and offers options for further transport to other destinations in Germany and internationally. In Germany, freight can continue its journey to Munich, Ulm, Kornwestheim and Basel in Switzerland. Beyond Germany, the rail operator offers connections to Slovenia, Italy, Spain, Turkey and Greece. In Rotterdam, the company offers optional transfers to nearby parts of the port.

China looks set to ramp up its investment in logistics infrastructure, following premier Li Qiang announcing what analysts called an “ambitious” economic growth target.

Among the investments announced this week were plans by Dalian to pump more than $33bn into its north-eastern transport network, including growing its port infrastructure and constructing a number of new rail bridges.

The ministry of transport noted that funds had been earmarked for a total of 187 projects, with Dalian “striving” for a 12% year-on-year increase in container volumes.

It added: “[Dalian] will actively open ocean routes in the Americas, Middle East, India and Pakistan, adding five new container routes through the year, and unblock large sea and land channels to create new China-Europe routes.

“[It will] realise a 3% increase in sea-rail intermodal transport volumes and improve the port collection and capacity of the North Grain South transportation channel.”

While the largest investment announced so far since the start of Chinese New Year, the news from Dalian reflects a wider push towards growing the country’s supply chain connectivity, with Shanghai’s regional government focused on increasing Yangtze River Delta flows.

This will include starting construction of a new container terminal, called Xiaoyangshan, at the city’s port, announced in 2022 at an expected cost of $7.3bn.

Furthermore, the ministry noted: “Shanghai will continue to promote the construction of the Shanghai section of the second phase of the Shanghai-China Railway and the Shanghai section of the Shanghai-Chongqing-Chengdu high-speed railway.”

Other regional rail projects include the construction of lines and launch of new services to provide better connectivity with Pudong International Airport.

In total, the country has set aside $173bn for transport projects over the coming 12 months, representing an increase of some $3.5bn on 2023’s budget, as China looks to rebound from a range of economic challenges, including deteriorating foreign direct investor confidence.

That – despite FDI accounting for 3% of total Chinese investment – seems to have been playing on the minds of the country’s leadership for months. At a Beijing supply chain conference in November, Mr Li urged the international community to rebuff what he described as a movement towards protectionism and uncontrolled globalisation – taken as a thinly veiled comment against the rise of India and Mexico.

Although forecasting 5% GDP for 2024 to some 3,000 delegates gathered in the Great of Hall of the People in Beijing, Mr Li nonetheless acknowledged it would not come easily.

He said: “The foundation for the continuous recovery and improvement of our country’s economy is still not solid, with insufficient demand, overcapacity in some industries, weak societal expectations and many lingering risks.”

And in direct response to investor concerns, the Chinese cabinet office said “all market access restrictions on foreign investment in manufacturing will be abolished”.

M/V Moresby Chief V. 2402E – Direct Vessel to Seattle

SUN CHIEF EXPRESS SERVICE

Hai Phong Ho Chi Minh

SI & VGM 09 Mar 2024 8-Mar 2024

CY cut Off 12 Mar 2024 10-Mar 2024

ETD 14 Mar 2024 12-Mar 2024

M/V Honiara Chief V.2402E – Direct Vessel to Seattle

SUN CHIEF EXPRESS SERVICE

Hai Phong Ho Chi Minh

SI & VGM 08 Mar 2024 12-Mar 2024

CY cut Off 11 Mar 2024 14-Mar 2024

ETD 15 Mar 2024 18-Mar 2024

Space open for booking on both two vessel, please inbox me for the aggressive spot rate & booking Ex Haiphong and Ho Chi Minh to:

1) Seattle

2) Chicago

3) Memphis

4) Minneapolis

5) Kansas City

6) Columbus

7) Cleveland.

Contact detail: 093 6433438/ 086 695 2112

PIC: Kevin Tran Email: kevin.tran@shipuwl.com

Liner operators say they are unlikely to emulate Maersk in using land transport to circumvent the Panama Canal restrictions, as moving containers by land in the Americas could drive costs up more than 30%.

In January, the Panama Canal Authority increased the number of daily transit slots to 24, despite first announcing a reduction to 18 for February. However, this is still fewer than the usual 36 daily transits through the waterway.

In response, Maersk announced its OC1 service from Oceania to North and South America would instead call at Balboa port in Panama on the Pacific side, and discharge boxes there.

In the opposite direction, vessels would discharge shipments for Australia and New Zealand at Panama’s port of Manzanillo, on the Atlantic side. These containers are sent by rail across the canal to be transhipped.

Last month’s Clarksons’ Container Intelligence Monthly stated that ONE had followed Maersk by announcing it would be using a ‘land bridge’ involving rail across Panama for some services, omitting canal transits.

However, a ONE spokesperson clarified to The Loadstar: “This is just a temporary land bridge operation for destinations of small volumes in the Caribbean Sea and South American east coast. We have conducted this operation in the past, even before the Panama congestion this time.

“This is just a similar case to past initiatives and, hence, we didn’t ‘follow in Maersk’s footsteps’.”

The spokesperson added: “Our service which hasn’t been able to pass the Panama Canal calls at Rodman port. Since there isn’t any rail service to Rodman, we’re temporarily adopting inland truck service if needed.”

A representative of ONE’s THE Alliance partner, Yang Ming, told land bridge options were not cost-effective.

“Land bridge movements account for just 10% of our US east coast services; because empty containers can only be transported back to Asia by seaborne transport, the cost of a landbridge is too high.

“Today, the freight rate from Asia to the US east coast is around $5,900 per 40ft. A normal Panama transit will take 37 days, but with the diversion round the Cape of Good Hope, you add five to six days. Using a land option will take around 30 days, but add nearly $2,000 to the cost,” he explained.