Hi, Winni. We prefer to book here. There are no freight rates at your business profile.

TRI VIET SERVICE TRADE IMPORT AND EXPORT CO.,LTD

Web: //trivietcargo.us. ; //worldcargo.com.vn.

Email:hungcargo59@gmail.com. HP: 0084.934086768, 0985225760. address: No.16, Street No. 5, Indochina house area 01, Area neightborhood 01,Phu Huu Ward, District 9, Ho Chi Minh City.skype: hungquocte.

TRI VIET EXIMCO., LTD (0084. 985225760) has ocean, air and trucking connections all over the world. We provide door to door service for your product to move smoothly.

TRI VIET EXIMCO., LTD (0084. 985225760) is a full service logistics company serving the entire world. We handle air, ocean, rail and truck shipments around the world. Either import, export or domestic shipments. We do it all.

Our growth can be attributed to very hard work and a relentless dedication to providing our customers with the best service and highest integrity they expect and deserve. We look forward to handling your cargo to wherever its destination might be. We will find the right company to work for your logistics needs. We are not related to any other company in the transportation business.

We make the complex world of transportation simple. We use reliable trucking and rail resources at the best rates. We find the ways to get your products delivered at rates you can afford on schedules you need.

Hello, we are Master Logistics FZCO, a shipping and customs clearance company in the free zone at Dubai Airport and the free zone at Jebel Ali International Port. We are honored to deal with you to provide you with excellent service and special prices - +971 52 189 3739

Please contact us for your shipments FCL/LCL to Colombo, Sri Lanka. .We issue D/O to cnee's here. Rgds/ Zain

A potential strike by 340,000 unionized workers at UPS Inc. threatens to unravel progress in tackling two of the U.S. economy’s biggest hurdles in decades: inflation and supply chain disruptions.

In the absence of a labor deal by Aug. 1, a walkout by members of the International Brotherhood of Teamsters would snarl shipments of the 19 million packages that UPS moves daily in the U.S. It would also enable competitors such as FedEx Corp. to raise prices to help manage some of the parcels that would pour into its networks.

Economists say the strike might raise the inflation rate — which the Federal Reserve has sought to curb via an aggressive tightening campaign after it reached a four-decade high of 9.1% last year. And if the Teamsters’ demand for much higher wages is met, this could be a harbinger for other outsized salary increases, further complicating the Fed’s effort to get price growth to its 2% annual target.

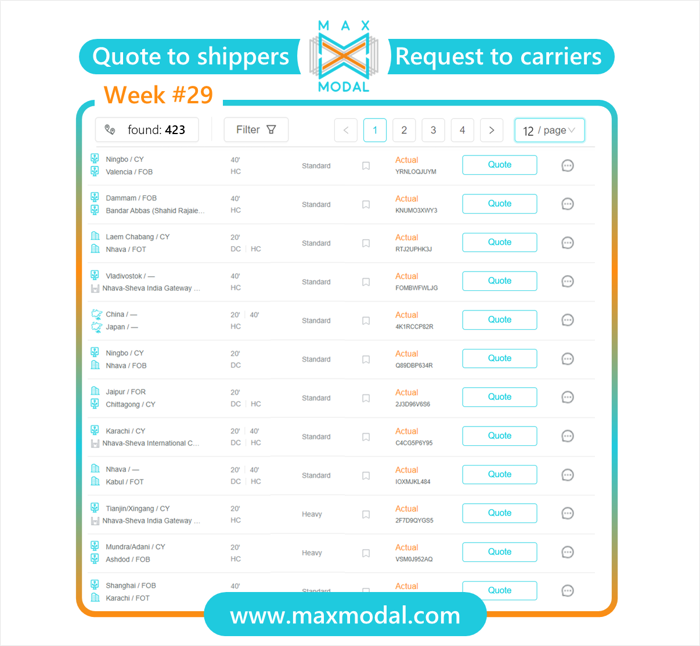

These are just a few examples of new requests at week #29. To get more fresh inquiries and\or the best quotes click here or push the «request management» button in the left menu.

SAMSKIP SEACONNECT UAB sells 23x45HCPW in seawhorthy condition. 45HCPW is the perfect equipment for shortsea shipments . It has 33 europlallets and 89 cbm intake. For the special offers please kindly contact to undersigned.

45ft HCPW makes your logistic solutions more efficient. Please contact us: anton.larkin@samskip.com for more details.

Hello, we are Master Logistics FZCO, a shipping and customs clearance company in the free zone at Dubai Airport and the free zone at Jebel Ali International Port. We are honored to deal with you to provide you with excellent service and special prices - +971 52 189 3739

Below is a brief presentation of our company Lanjjoscargo, we are an international cargo agent and also act as a Customs Broker.

We serve throughout Latin America, Asia, Europe and many other countries.

Lanjjoscargo is a reputable and famous company for dealing with atypical foreign trade situations, as well as normal everyday situations, enabling and offering quality international and national logistics.

Seeking agility in the process and a lower cost within the possibility and always updating ourselves for the most adverse situations and accompanied by changes in new legislation that arise at each moment.

Our team is made up of professionals working in the import and export market with more than 25 years of experience in the market, who have great know-how in the textile and clothing sector.

We operate in all modes of transport (Road, Air, Sea).

We are waiting for your soon return.

Hi. Anton Larkin

msg well noted and we will find out about this in our country and avice.

Rgds

/Zain

Hi Friends

Please feel free to contact us If you have any shipments to/from COLOMBO, Sri Lanka.

OUR SERVICES IN COLOMBO

-----------------------------------------------

1. International Freight Forwarding

2. Resisted Customs DTI /Sl Customs House Agent.

3. Customs Clearance Import LCL/FCL / Bulk Cargo /

4. Projects cargo Clearance and Movements to Site.

5. BOI / Customs approval for special cargo / Consultant.

6. Customs Clearance and Door Deliveries

7. De-consolidator / Issue / release D/O to cnee's

8. P.O.D.Advice & Remittance within 03 working days.

9. Trans-shipment/Re-shipments / SHIP SPARS Delivery

10. Door to Door Service

11. Local Transport Etc; ETC;

Please do not hesitate to contact us at any time and YOUR SUPPORT TO US WILL BE HIGHLY APPRECIATED.

Awaiting for your reply.

Tks & Best Rgds

ZAIN Thahar

GREENWHICH INT'L FREIGHT SERVICES

[ International Freight Forwarder]

# 33/5A,PALITHA PLACE, COLOMBO 09.

SRI LANKA.

TEL: 00 94 115743338,2667845

FAX: 00 94 112667845

Mobile. 00 94 0785 666 250

E-MAIL: thahar@dialogsl.net;

MSN:

Noted with tks.

Whether it is Sea, Air, or Land, we, being a Global Shipping and Freight Forwarding Company, have your interests, on Shipping and Freight, suitably covered and assist you with your transport and logistics needs. As our partner-in-progress, we both can grow together for mutual benefits.

Superior Operational cognizance and thus, excellence, in our modus operandi, ably assist us in offering you superlative deliverables, with quick TAT [turn around time], reliable, consistent, and top-quality services at competitive and reasonable rates.

We believe, respect, and nurture the values we contribute to your businesses, putting you first.

We provide a complete end-to-end relocation service. The minute you decide to make an international move, you want people with experience on your team. Shifting between nations is different from moving between states. It comprises legal permissions, customs inspections, insurance, health care considerations, and other cultural factors. Chevron Sea Shipping – international movers UAE, has the answers. We handle thousands of international relocations and we bring years of experience and know-how to each.

Personal Cargo – In international moving, Chevron Sea Shipping also provides personal cargo services. If the customer wants to send any gifts/ anything personal to family/friends, Chevron Sea Shipping will send it through an international moving service. Personal things can include pets, vehicles, gifts, etc. Don’t worry; we will take care of all the things with the client’s requirements. You will receive standard shipping and appropriate vehicles when you use our international cargo service. Customers can count on our professionals and can feel that all goods were safe in their hands.

Commercial Cargo – Chevron Sea Shipping offers reliable solutions to each customer’s specific requirements. We offer safe, efficient, and cost-effective commercial cargo transportation solutions. We have high-quality on-time service and good knowledge of transporting all types of goods around the globe. Chevron Sea Shipping offers the most competitive rates for import & export commercial cargo shipping. Chevron Sea Shipping offers international shipping services including ocean, air, and truck. We have the knowledge, network, and skills to pick up all your cargo and handle international shipping & cargo services.