Read the latest overview, trends, and prospects of the logistics and transportation markets in the aftermaths of the latest crisis in today’s digest:

Recent events in Ukraine have resulted in significant aftermaths on the logistics and transportation markets that had already been in a perplexed state. MAXMODAL has prepared an overview of the major points and trends happening across the main transportation modes.

● Security consultancy has warned all shipping to leave the Black Sea area around southern Ukraine. The proposal has more of a preventive character since the Black Sea region is now complex. Experts predict that if companies restrict shipping to Crimea, southern Ukraine, and the Sea of Azov, they will be able to avoid bigger disruptions.

● Meanwhile, spot rates are picking up on their growth, after being flat for a while, due to the soaring oil price which has gone up to more than $105 a barrel. The increase in rates is especially prominent in the US. The west coast component increased 3% to $11,030 per 40ft, while on the US east coast, the increases were more modest, up 1% to $13,160 per 40ft. Some companies report that it seems like the longer they wait with signing contracts, the higher spot rates will be.

● Airfreight is seeing restrictions on air cargo, as flights are being re-routed due to the closure of the sky. Ukraine International Airlines has suspended scheduled and charter flights to and from the country. Experts have already voiced out the consequences of potential sanctions on Russia for Russian airfreight. Some of them include challenges for lessors that pay in euros, a possible shortage of titanium for production lines, and so on.

● Rail transits on the China-Europe route have not been affected yet as Ukrainian Railways has announced that it is not planning to halt its passenger and cargo traffic, however, many believe that it may not last for long, especially since it has already made spot rates increase. In turn, China has confirmed that no disruptions are expected on the transportation toes from Russia through Belarus. Nevertheless, if promised massive sanctions are imposed, Moscow could organize a go-slow or a complete halt in transiting freight. Although Ukraine constitutes only 2% of the westbound container traffic volumes on the New Silk Road last year, there is now a trend of rising volumes, so in the long run, the political instability will be a deciding factor to what extent the route will be developed.

● Transits through Russia by the US are shrinking. In particular, Flexport announced that it had ceased accepting bookings on China to Europe Trans-Siberian railroad service for the time being.

● Rate hikes and oil prices spikes are making already vulnerable supply chains primary targets of cyberattacks. Some have already occurred this week with Expeditors and Nhava Sheva. Companies brace up against predicted significant delays for road and rail routes through Ukraine and neighboring countries.

● Delays will not omit the marine sector either. Ukrainian national ports have been shut down.

The more ports get closed, the stronger global congestion remains. Despite the talks that it is easing at the Port of LA and the Port of Long Beach, the dynamic is still worsening. This is due to stronger than expected US retail sales in January paired with low retail inventories. Thus carriers will be busy for months ahead. Therefore, the US is going to invest $450 million in the Port Infrastructure Development Program to expand ports’ capacity and improve the movement of goods through the supply chain.

The trend of diversifying Chinese suppliers is becoming more popular among European and American companies. Potential new markets include Turkey, India, and South-East Asia. Meanwhile, another tendency closely linked to the diversification of sources, that has been on the rise, shipper-owned containers, gains new followers among freight forwarders. SOCs are a solution to equipment imbalances, although it can be rather costly. Another rather expensive aspect that has been bothering shippers, is the price that UK shippers have to pay to get their goods from Asia compared to their neighbors on the continent. For them it is $1000 higher in the post-Brexit reality.

The global trade in liquefied natural gas (LNG) rose by 6% to 380 million tonnes during 2021, as many countries rebounded from the impact of Covid-19. China and South Korea were the leaders last year. South Korean companies are thriving for more autonomy: SM Line has decided not to renew its Transpacific slot-sharing agreement with the 2M alliance choosing to go solo on this route. In turn, China is expected to benefit from the plans of Iran and Afghanistan to extend their shared connection thanks to the development of the East-West railway corridor, which theoretically connects China and Europe through these two countries. In the meantime, DB Cargo UK and automotive logistics operator Groupe CAT have launched their international Toyota car-carrying service to the north of France. The European Commission has approved the planned merger between Cargotec and Konecranes that aims to become a leader of sustainable material flow, However, the completion of the merger remains subject to further feedback and approvals from various other competition authorities.

The industry has long been preaching for the development of rail, however, only now does it seem to realize the primary objectives of improvement and most importantly, evaluate the financial aspect of it.

Towards the fastest trains in Eastern Europe is the leitmotif of the decision of Russia and Hungary to join railway ventures. The company will start operating in spring with the primary objective to play the role of an operator and logistics forwarder on the New Silk Road. By April 2022, both parties plan to move to operational work, with a gradual increase in turnover. Priority to rail is now a thing for the majority of the EU big players in general, despite the needed recovery from the storms. Thus, more investment is needed. As one of the results of the European Railway Summit, the participants have signed European Railway Pact preaching for further development in a green, sustainable way. The UK, in turn, focuses on local development and thanks to the research finds out that Birmingham could be a much greater contributor to the net-zero carbon economy, so the development will be focused on it. The pivotal role of railway connection increases across all directions with a particular emphasis on China. Although China has been very rigorous with rail development lately, it is not a secret that the EU will benefit from it too. COSCO has launched a new train to Germany carrying raw chemical materials, auto parts, daily necessities, etc. The connection is another +1 to COSCO’s already impressive network in Europe. Maersk levels up its game as well by introducing a freight service linking Korea, Japan, and China to the Kaliningrad Region in Russia, the Baltic countries, and Poland through Trans-Siberian. Shorter transit times aim to move goods shipped from the Far East to Europe faster while reducing the impact of the supply chain crisis. In the meantime, a faster pace becomes a distinguishing attribute of the New Silk Road too, but it is not necessarily a good thing. The slowdown is due to decreases volumes because of the Chinese holidays and a slight drop in spot rates. Experts advocate for further digitalization and infrastructure investment in rail facilities.

Another challenge is the new road toll rules introduced by the EU that clearly favor operators of hydrogen and battery-electric heavy goods vehicles, as they will receive significant toll discounts. In this case, many say that road transport has more advantage in terms of competition than rail. Electric trains are green too however, they continue to pay without any reduction in rates. A long period of negotiations is ahead. Another legislative aspect that pops on the agenda of the EU leaders is the protection of member states from third-party coercion that may arise as a result of a closer relationship with China. As all the involved parties have expressed the need for cooperation, the question of the proper framework becomes essential.

Competition has been the burning issue not only for the rail. Ocean freight had encountered the unfair practices first. The UK, the US, Australia, New Zealand, and Canada are going to conduct investigations of unfair practices. According to some experts, the current supply chain disruptions are a direct result of anti-competitive conduct, which has only escalated during the pandemic and led to poor service and huge fortunes of the major players. The EU commission has not joined the initiative. The thing is there is such phenomenon as Consortia Block Exemption Regulation, which allows agreements between maritime shipping companies to cooperate in ‘consortia. The paper is due to expire in 2024, however, the Commission does not exclude the potential of prolonging it.

The trend of shippers accepting shipper-owned container requests was previously mentioned, and now it keeps growing because its biggest advantage is that it increases reliability for empty container availability. The tendency indicates that the current supply chain crises push industry participants to diversify their sources. However, the same crisis has requested more containers to be used due to the delays that continue to disrupt the performances of the companies, and many players fear the chaos that these containers are going to create once congestion eases. Container shortage is also due to the occasional container loss. The recent one occurred near the Netherlands. The disruptions are also toped with the new cyber attacks. Expeditors, a global logistics giant, has become the target and had to shut its operations. India’s top container port complex, JN Port Container Terminal, has also suffered from a cyber attack. However, four neighboring terminals are functioning normally.

After breaking another record, charter rates are expected to slightly decrease. However, even the high prices do not prevent daily hires from breaking out. Moreover, owners continue to be besieged with offers on the S&P market. The correction in rates will be possible due to the ease of congestion in Q2. The unpredictable dynamic does not prevent new players from emerging. This time it is a young, Alibaba-affiliated, liner Transfar from Thailand that has launched China-US east coast sailings.

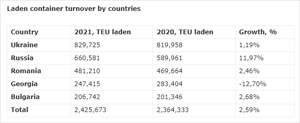

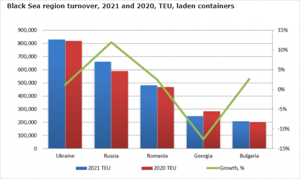

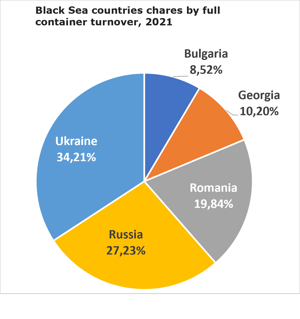

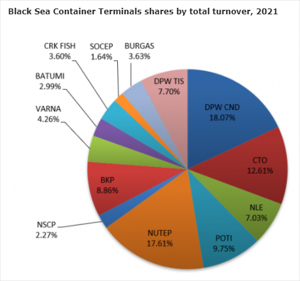

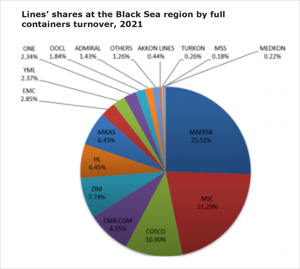

Black Sea Container Market Review 2021: 2M Alliance partners remain the leaders of the region

For more information read here

The U.S. ports are one of the busiest and yet the least efficient. How come? Interesting explanation here: